Example - Prepaid Leasing Cost

In the example below, we will look at the creation of auto-generated documentation for account 1397 Prepaid Leasing Cost.

- The company leased a vehicle on 01.05.2024 and paid a starting lease of NOK 400,000 covering a total period of 36 months.

- The company starts using the new documentation type as of the reporting period January–February 2025.

- They have already expensed 8 months of the prepaid lease in 2024.

They create the new documentation attachment for account 1397 by clicking the “binder clip” and creating the documentation type “Prepaid expenses (auto-generated)”.

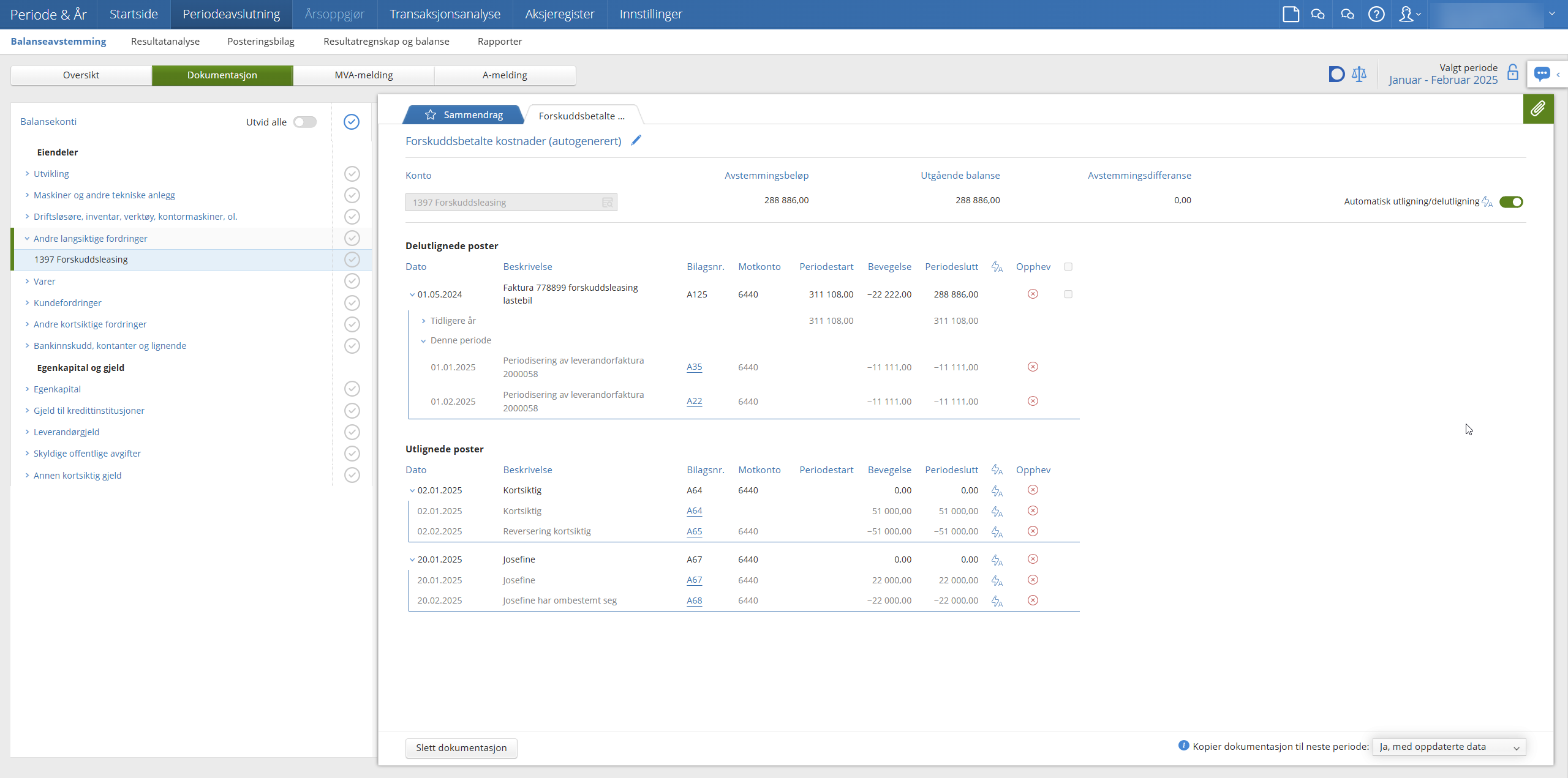

The user then sees the following screen:

We see here that Period & Year finds the period’s net movements to be NOK -22,222.00. The ending balance on the account is NOK 288,886.00. This results in a reconciliation difference of NOK 311,108.00

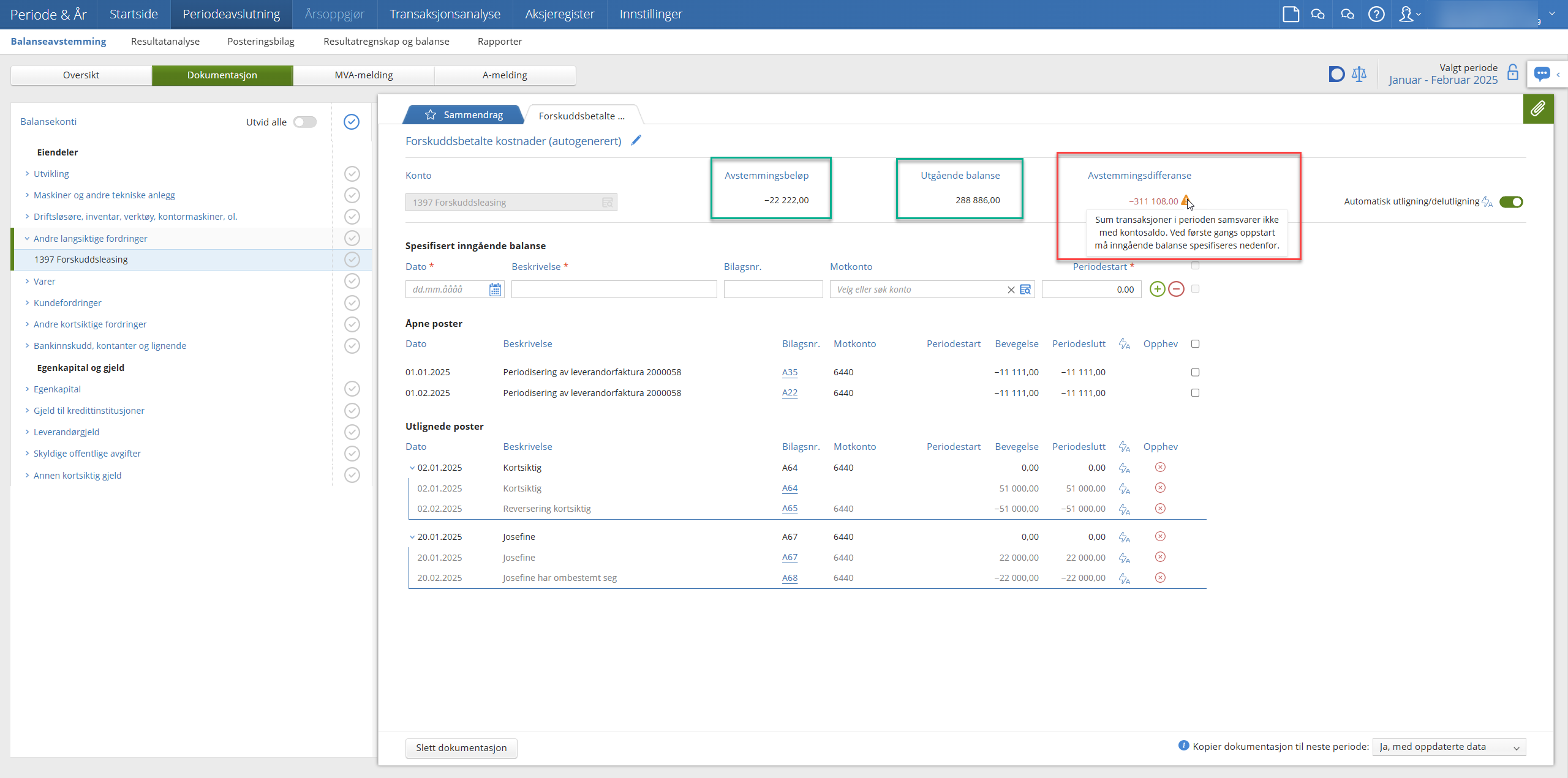

The reason for the reconciliation difference in this case is that Period & Year is unaware of the historical movements from previous periods.

It must therefore be specified what the opening balance consists of. In this case, it consists of the 400,000.00 in prepaid leasing minus 8 months of expensing in 2024, which amounts to NOK -88,892.00.

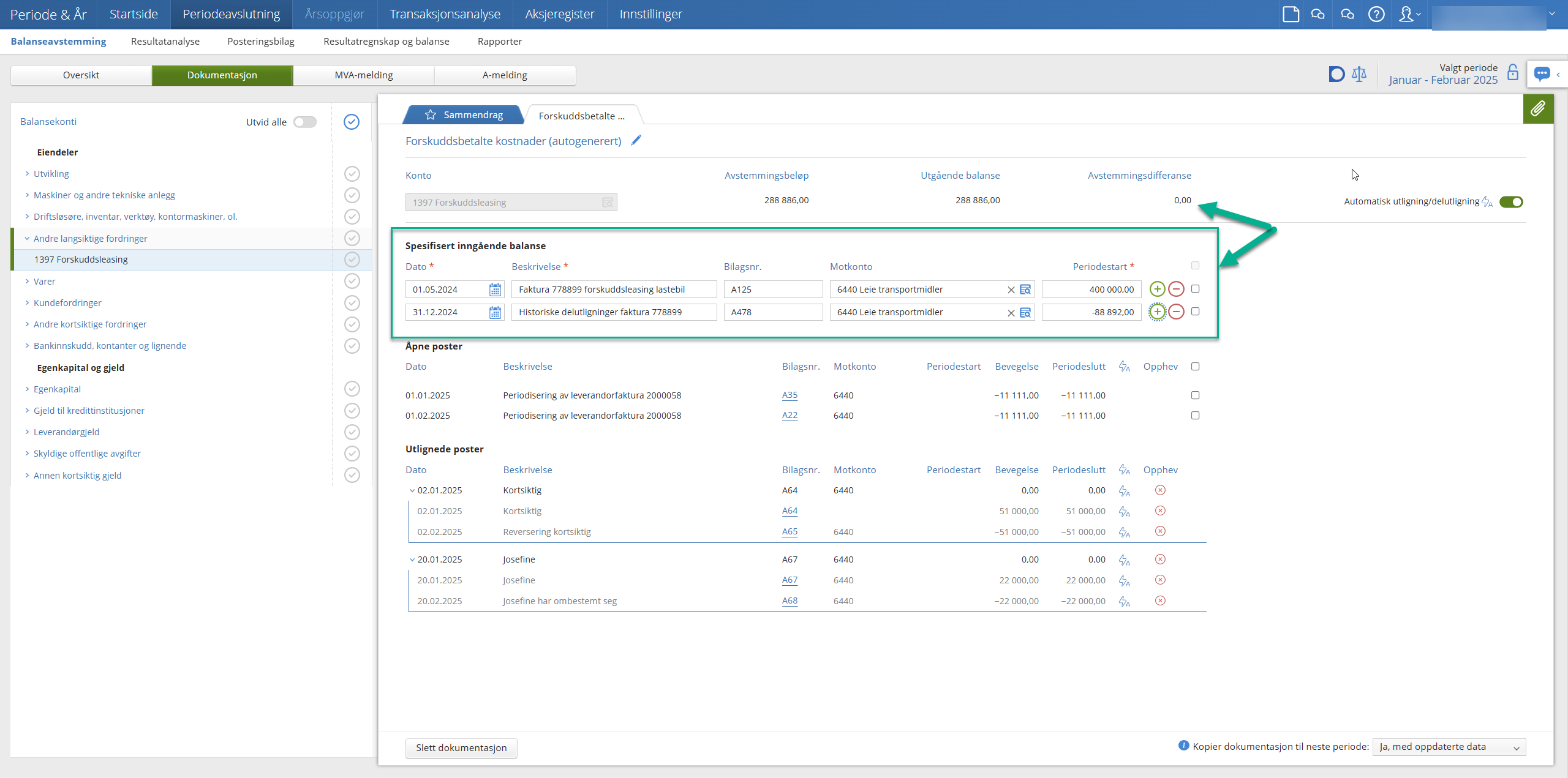

This is recorded as two custom lines which, in the reconciliation, will be added to the period’s recorded transactions.

Partial clearing/clearing of open items can now be applied to these custom lines and any other transactions belonging to this transaction group.

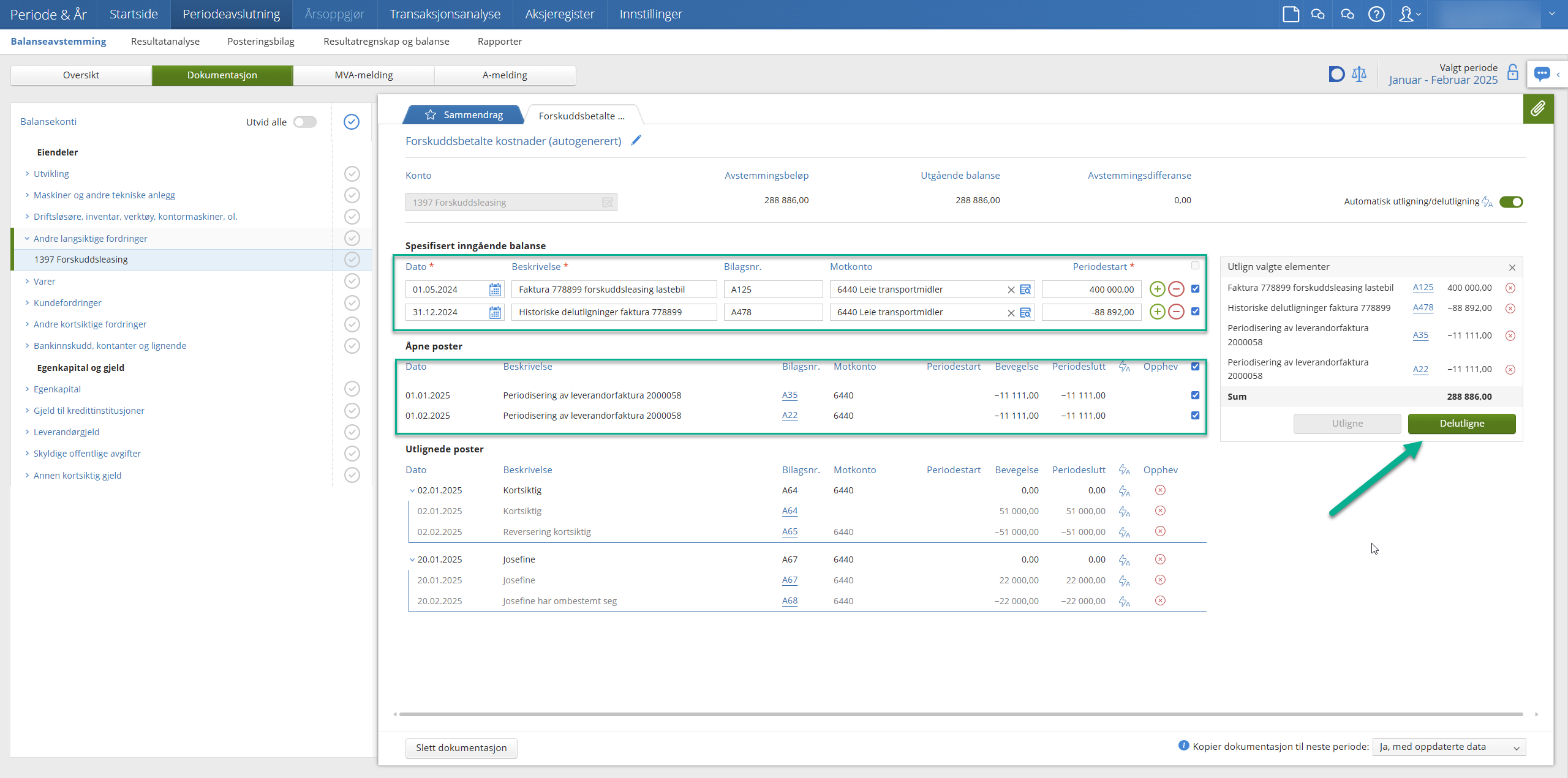

When an entry is selected, a new dialogue box appears to the right of the period’s transactions. This calculates the sum of the entries that are selected.

Result after partial clearing has been made.