January 2026

Balance Reconciliation - New Solution for Reconciliation of VAT, Employer’s Social Security Contributions, and Withholding Tax

Effective for financial years starting after January 1, 2026, you will have access to a new solution for reconciliation of taxes related to VAT returns and A-melding (employee reporting).

The new solution is divided into 3 sections for all three tax areas:

- Reconciliation of recorded values against reported taxes to Altinn

- Reconciliation of outstanding balance at the end of the period

- Automatic detection and documentation of payment vouchers

For VAT, the new solution will additionally include the following:

- Ability to reconcile recorded basis values for outgoing VAT

- Handle and reconcile clients with reporting of multiple different VAT returns for different industries, e.g., a client with both bi-monthly and annual VAT returns

- Support for various VAT periods: Weekly, semi-monthly, monthly, bi-monthly, quarterly, semi-annually, and annually

The new solution will also take into account the discontinuation of the mandatory tax withholding account effective from January 1, 2026. Download of A-melding furthermore supports the Norwegian Tax Administration’s new format.

Non-standard financial years that have a start date before January 1, 2026 will continue to use the previous reconciliation solution, including for the portion of the financial year that extends into 2026.

See help documentation for more information.

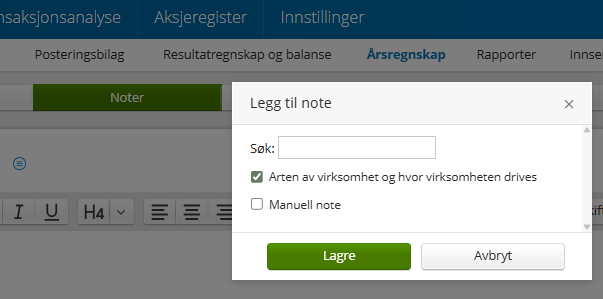

Annual Report - new note: “Type of business and where the business operates”

A new standard note is now available under Annual Report. The note should provide information about the nature of the business and its location, and it can be added and filled in manually from ‘Introductory (unnumbered)’ notes.

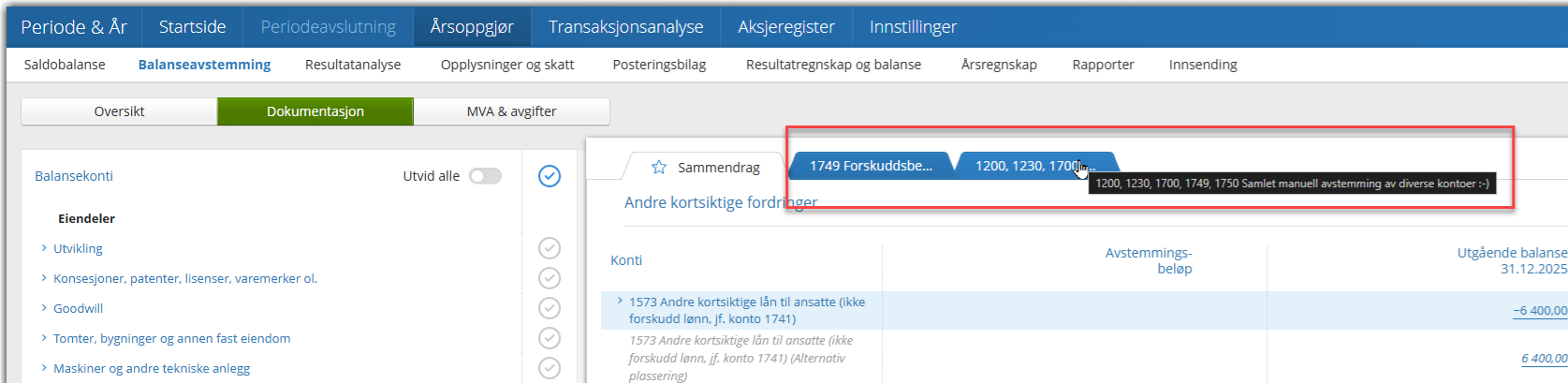

Balance reconciliation – automatic account numbers in documentation names

To help you quickly identify which account is linked to each documentation attachment, Period & Year will now automatically add the account number to the documentation name.

This will apply to the Balance reconciliation view and when selecting which documents to generate under Reports.

ERP integration - enhanced agricultural support

It is now possible to import agricultural clients from the following sources:

- Duett

- Unimicro

- DNB Regnskap

- Sparebank 1 Regnskap

- Eika Regnskap

When importing agricultural clients from these sources, accounts are imported including agricultural departments. Manual and system entries will now also include agricultural departments as part of the postings when exporting back to the source.

Read more about the integration in Import from agricultural clients.

Third party information - opened for submission

Altinn has opened for submission of third party information for income year 2025. Go to Year-end closing - Submission or Housing - Submission to submit new information.