Manage credit policy

/visma-net-erp/help/customer-ledger/manage-credit-policy

section

2026-02-19T17:09:06+01:00

# Manage credit policy

Manage credit policy - overview

/visma-net-erp/help/customer-ledger/manage-credit-policy/manage-credit-policy-overview

page

Businesses do not always pay their suppliers immediately for received goods or services.

2026-02-19T17:09:06+01:00

# Manage credit policy - overview

Businesses do not always pay their suppliers immediately for received goods or services.

Businesses do not always pay their suppliers immediately for received goods or services.

To

avoid running out of cash, your company may need to set up proper management of customer

credit.

Credit management tools may include tools for managing customer credits, tracking

customers' outstanding balances, and treating bad debts.

With Visma Net, you can use the following credit management tools:

+ **Payment terms** You configure payment terms to define documents' due dates. Payment terms may be used for giving a customer discount for early payment. For details on configuring and applying payment terms, see: [About payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/about-payment-terms/).

+ **Credit verification** You can enable a credit check process for each customer that automatically puts overdue invoices on hold and forbids the issuing of new invoices for a customer that has failed a credit check. For details on configuring and applying credit verification rules, see: [About credit verification](/visma-net-erp/help/customer-ledger/manage-credit-policy/about-credit-verification/).

+ **Customer credit hold** You can manually put a customer on hold any time you consider it necessary. For more information, see: [About customer credit hold](/visma-net-erp/help/customer-ledger/manage-credit-policy/about-customer-credit-hold/).

+ **Overdue charges** You can configure additional charges to be applied to outstanding balances of customers who are consistently paying too late or not paying in full. For details on configuring and applying overdue charges, see: [About overdue charges](/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charges/).

+ **Statement cycles** You can configure customer statement cycles to provide customers with information about their balances with your organisation. For details, see: [Statement cycles - overview](/visma-net-erp/help/customer-ledger/manage-credit-policy/statement-cycles/statement-cycles-overview/).

+ **Dunning letters** You can configure a series of dunning letters to remind customers about overdue invoices. For details on configuring customer notifications, see: [Manage dunning letters - overview](/visma-net-erp/help/customer-ledger/manage-dunning-letters/manage-dunning-letters-overview/).

+ **Direct write-off method** You can use the direct write-off method to handle expenses that are required to run the business or that have been incurred in the operation of the business. For details on configuring and using direct write-offs, see: [Write-off methods - overview](/visma-net-erp/help/customer-ledger/manage-credit-policy/write-off-methods/write-off-methods-overview/).

> [!NOTE]

> We do not recommend that you use the direct write-off method for handling bad debts as it often violates the matching principle of accounting because it recognises bad debt expense that is partly related to a previous accounting period.

+ **Allowance method** You can handle bad debts by using the allowance method. The allowance method is a better alternative to the direct write-off method because it follows the matching principle of accounting. For details on configuring and using allowance method, see: [Write-off methods - overview](/visma-net-erp/help/customer-ledger/manage-credit-policy/write-off-methods/write-off-methods-overview/).

The following topics will help you to configure and use the credit management tools of your choice.

## Topics

+ [About payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/about-payment-terms/)

+ [About credit verification](/visma-net-erp/help/customer-ledger/manage-credit-policy/about-credit-verification/)

+ [About customer credit hold](/visma-net-erp/help/customer-ledger/manage-credit-policy/about-customer-credit-hold/)

+ [About overdue charges](/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charges/)

+ [Statement cycles - overview](/visma-net-erp/help/customer-ledger/manage-credit-policy/statement-cycles/statement-cycles-overview/)

+ [Write-off methods - overview](/visma-net-erp/help/customer-ledger/manage-credit-policy/write-off-methods/write-off-methods-overview/)

Related pages

Concepts

About customer credit hold

/visma-net-erp/help/customer-ledger/manage-credit-policy/about-customer-credit-hold

page

You may encounter an unfortunate situation when a customer has not paid for a long time and has not responded to any inquiries or requests for payment.

2026-02-19T17:09:06+01:00

# About customer credit hold

You may encounter an unfortunate situation when a customer has not paid for a long time and has not responded to any inquiries or requests for payment.

You might have notified the customer about due invoices with a series of dunning letters or in some other way. You can put a hold on the customer's credit until the issue is resolved.

An employee who is authorised to manage customer credit can apply credit holds to the customers involved by using the [Manage credit holds (AR523000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/manage-credit-holds-ar523000/) window. Once a credit hold has been applied to a customer account, no new sales orders or invoices can be created for this customer.

An authorised user can manually release a customer from credit hold by changing the customer

status from **Credit hold** to **Active**.

To do this, the authorised user's role should

have access to the **Status** field of the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window.

Related pages

Concepts

Windows

Payment terms

/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms

section

2026-02-19T17:09:06+01:00

# Payment terms

About payment terms

/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/about-payment-terms

page

Payment terms define the specific details of the seller's payment requirements that the buyer should meet in order to purchase goods on credit.

2026-02-19T17:09:06+01:00

# About payment terms

Payment terms define the specific details of the seller's payment requirements that the buyer should meet in order to purchase goods on credit.

Payment terms define the specific details of the seller's payment requirements that

the buyer should meet in order to purchase goods on credit.

These details include the date when a payment should be made, the conditions for cash discounts when any outstanding balance is paid early, and the setting that determines whether an outstanding balance is to be paid as a single instalment or in multiple instalments.

In this topic, you will read about how to set up payment terms and assign them to

business accounts (customers and suppliers), and how to configure instalment buying

and cash discount offering.

Also, the topic explains the details of calculating the

payment periods and cash discount periods.

## Plan payment terms

You need to plan the payment terms your company offers to customers, as well as

outline the details of the payment terms offered to your company by suppliers, which

are already defined, in preparation for entering them into the system.

We recommend

that you decide on the following points when you plan each set of payment terms:

+ The length of the payment period and the ways its due date is calculated.

+ The cash discount conditions and the way they are affected by the length of the payment period.

+ The number of instalments and the instalment payment schedule (if the company offers instalment buying).

> [!NOTE]

> You can configure a cash discount for only a single-instalment payment.

If your company has been operating for some time, you already have established payment

terms.

We recommend that you compare the payment terms your company offers to

customers and the payment terms offered to your company by suppliers, because in Visma Net, you can use the same payment terms for both customer payments and payments to

suppliers, if needed.

## Set up payment terms

These are the general steps you need to perform to create a set of payment terms by using the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window:

1. You specify a descriptive ID for the payment terms you want to configure. The length of an ID can be up to 10 Unicode symbols.

> [!NOTE]

> We do not recommend using any special symbols in the IDs of entities.

1. You define the scope of the payment terms: whether they apply to only customer documents, only supplier documents, or both types of documents.

1. You configure how a due date is calculated for a document.

1. Optional: You configure the cash discount conditions.

1. Optional: If needed, you change the default instalment type of payment terms, which is **Single**, to **Multiple** and define the number of instalments and their payment schedule.

## Configure the assignment of payment terms

By using the payment terms that have been manually or automatically assigned to a

document, the system calculates the due date of the document.

If a cash discount is

applied, the system also calculates the end date of the cash discount period and the

cash discount amount for the document.

In Visma Net, you can assign payment terms to the following types of documents:

+ Customer ledger: Invoices, debit notes, and overdue charges

+ Supplier ledger: Purchase invoices and credit adjustments

To make the system automatically assign payment terms to customer documents, you

assign the payment terms to customer classes, and by default, a customer is assigned

the payment terms specified for the customer class it belongs to. You can manually

specify the payment terms for each customer (or override the class setting) by using

the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window. When you

create a document and select a customer, the system automatically associates with

the document the payment terms specified for the customer.

(The payment terms for the

document can also be overridden.)

Automatic assignment of payment terms to supplier documents is configured similarly to automatic assignment of payment terms to customer documents, with terms being assigned to supplier classes. You also can manually specify or change the payment terms for each supplier by using the [Suppliers (AP303000)](/visma-net-erp/help/supplier-ledger/supplier-ledger-windows/suppliers-ap303000/) window.

## Set up due date calculation

Certain settings specified for the payment terms in the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window determine the payment period: the time interval that starts when a customer purchases a product or a service (on the document date) and ends when the customer's payment is due. In Visma Net, you do not specify the length of the payment period; you instead specify the way the document due date will be calculated based on the date of the document's creation.

By specifying the appropriate **Due date type** setting in the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window, you can calculate the due date based on one of the following factors:

+ **A day in a month** (the **Day of next Month**, **End of month**, **End of next month**, and **Day of the month** options): You can specify a day of the month (in the **Due day 1** field) to be the due date for all documents issued before this day, or the end of the current or next month can be the due date.

+ **A fixed number of days** (the **Fixed number of days** and **Fixed number of days starting next month** options): You can specify the period of time (in the **Due day 1** field) that is used to calculate the due date, based on the document date or the first day of the next month. (To determine the due date of the document, the system adds the specified number of days to either the document date or the first day of the next month.)

+ **Multiple custom dates** (the **Custom** option): With this option selected, you can set two time intervals for the document dates and specify a due date for each interval. The parameters for configuring the first interval are **Due day 1**, **Day from 1**, and **Day to 1**, and the parameters for configuring the second interval are **Due day 2**, **Day from 2**, and **Day to 2**.

The following rules are applied to each set of days:

+ The end day should be greater than the start day.

+ If the value of the **Due day N** parameter is greater than (or equal to) the value of the **Day to N** parameter, the due date will be in the current month.

+ If the value of the **Due day N** parameter is less than the value of the **Day to N** parameter, the due date will be in the next month.

> [!NOTE]

> **Attention**:

> If a document date doesn't match either interval, the due date

> won't be calculated.

> For example: If a document is dated 1/31/2018 and the intervals

> are 1–15 and 16–30, then the due date won't be calculated for the

> document.

For more examples of the ways a payment period is calculated, see: [Examples of credit and cash discount periods.](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/examples-of-credit-and-cash-discount-periods/)

## Configure instalment payments

Outstanding balances can be paid in a single instalment or multiple instalments.

To

configure instalment payments, select the **Multiple** option in the

**Instalment type** list.

By default, the instalment type for new payment

terms is **Single**.

You then specify the number of instalments, the frequency

or schedule, and the instalment method.

You can configure either an instalment frequency or an instalment schedule.

To

configure a frequency, in the **Instalment frequency** field, you

can select the interval between instalments.

The following payment frequency

options are available:

Weekly

: Instalments will be one week apart.

Monthly

: Instalments will be one month apart.

Semi-monthly

: Instalments will be a half a month apart.

To determine how the amounts of instalments are calculated for the selected frequency, select one of these options in the **Instalment method** list:

Equal parts

: The document total amount (with all the applicable taxes added) is divided into equal parts.

VAT in first instalment

: The amount of the document (the total before VAT) is divided into equal parts, and the VAT amount is added to the first instalment.

To configure an instalment schedule, you leave the **Instalment frequency** field blank and select the **Split by percent in table**

instalment method.

The instalment amounts are calculated according to the

percentages that you specify for each instalment in the **Instalments schedule** table.

For each instalment, you can specify the number of

days from the due date and the percent of the total document amount.

The first

instalment (which is due on the due date) should have **0** in the **Day**

column, and other instalments' dates are specified with the respect to the due

date.

## Configure a cash discount

You can configure a cash discount for only single-instalment payment terms.

The cash

discount is available for a time interval (that is, the cash discount period) that

starts on the document date and ends in the number of days specified in the

**Cash discount settings** section. The cash discount period

falls within the payment period.

If custom due dates are set, discount settings are

applied to both intervals.

The length of the cash discount period is defined by the following parameters:

Discount type

: This parameter defines the method of calculating the end date of the discount period (which is similar to the method of calculating the due date). The option you select in the **Due date type** field determines the options available for selection in the **Discount type** field. If the **End of month** option is selected in the **Due date type** field, configuration of a cash discount is not available.

Discount day

: This parameter determines the number of days or the particular day of the month, depending on the method selected in the **Discount type** field.

For examples of the ways a cash discount period is calculated, see [Examples of credit and cash discount periods.](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/examples-of-credit-and-cash-discount-periods/)

A cash discount is an amount that is calculated by applying the percent specified in

the **Discount %** field to the total amount of the document.

When

you enter a payment for the document during the cash discount period, the system

deducts the calculated discount amount from the total amount of the document and

generates the payment for the amount or the result of the

deduction.

If a cash discount is applied to a document, it may or may not affect how the system

calculates the taxable amount of a document.

You may indicate to the system how to

calculate the taxable amount for a VAT application in the [VAT (TX205000)](/visma-net-erp/help/vat/vat-windows/vat-tx205000/) window.

For details about how the system

calculates a taxable amount of a document if a cash discount should be applied to

the document, see: [About VAT settings.](/visma-net-erp/help/vat/manage-taxes/about-vat-settings/)

Related pages

Concepts

Tasks

Windows

Examples of credit and cash discount periods

/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/examples-of-credit-and-cash-discount-periods

section

In this topic, you can find examples that demonstrate how the credit period and cash discount period are calculated based on the calculation method of the applicable payment terms.

2026-02-19T17:09:06+01:00

# Examples of credit and cash discount periods

In this topic, you can find examples that demonstrate how the credit period and cash discount period are calculated based on the calculation method of the applicable payment terms.

## Structure of these examples

Each section describes a particular method of calculating the length of credit period and discount period defined by the payment terms. You select the calculation method in the **Due date type** field in the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window.

In each section, the first column of the table lists the options that you can select in the

**Discount type** field, based on the method selected for due date

calculation.

The second column contains sample settings for each option that you could use to

configure the payment terms in the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window, as well as

the document date from the Visma Net

window used to create the document. The third column displays the resulting payment period and cash

discount period for the document date specified in the sample settings. This column includes a

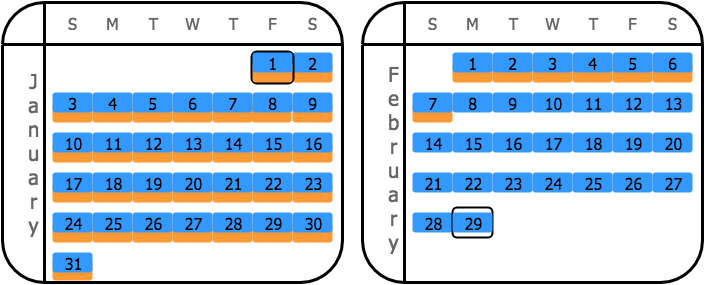

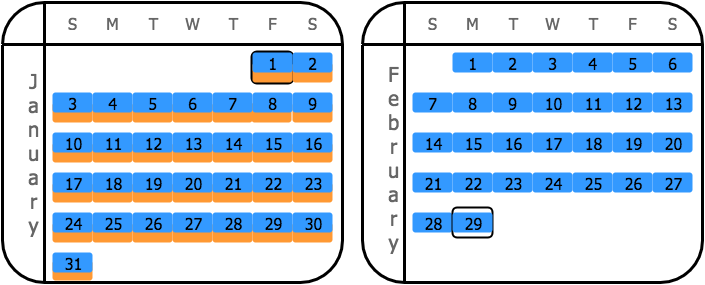

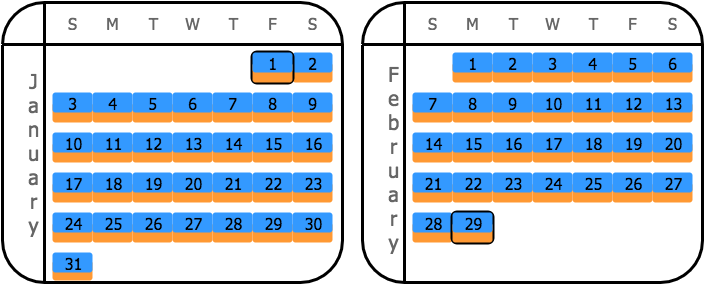

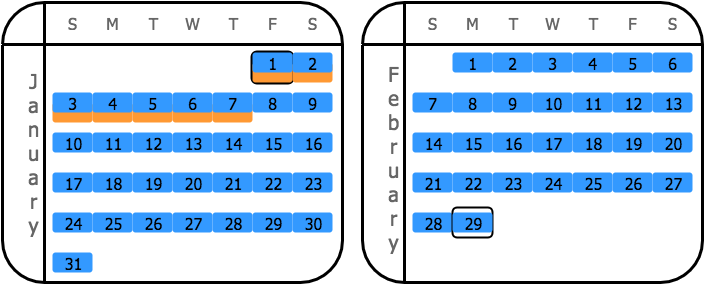

diagram that shows the resulting credit period and cash discount period. The legend of the

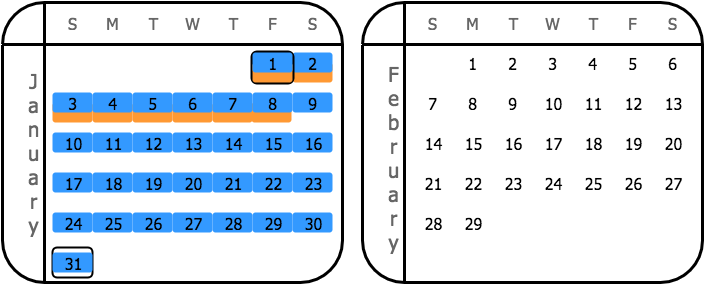

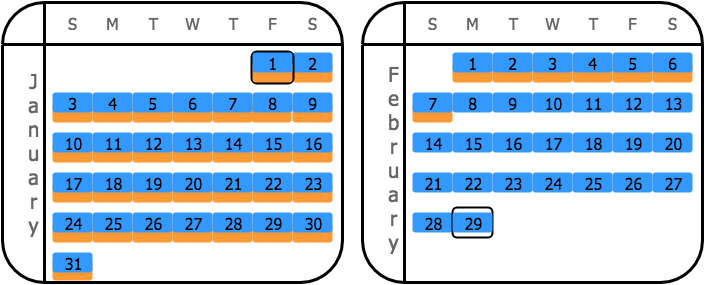

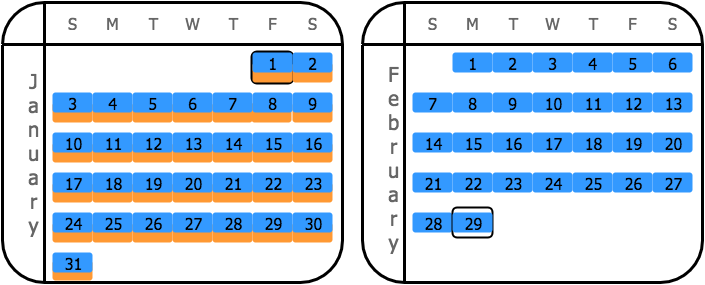

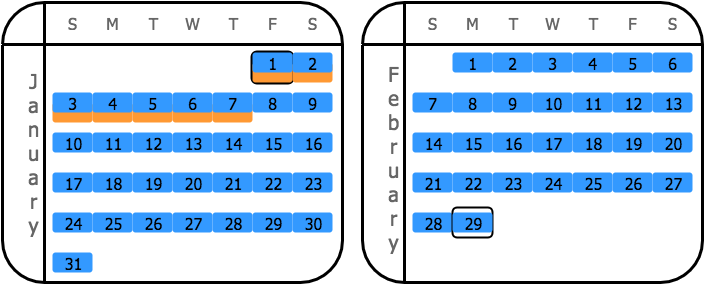

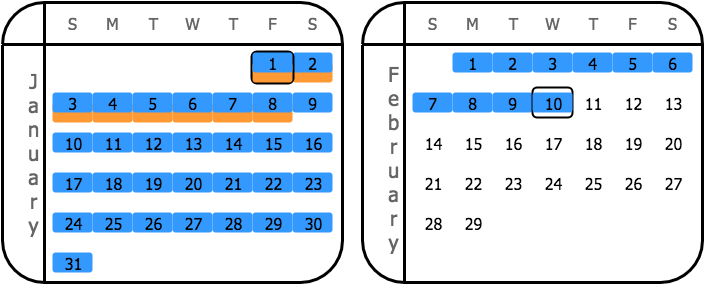

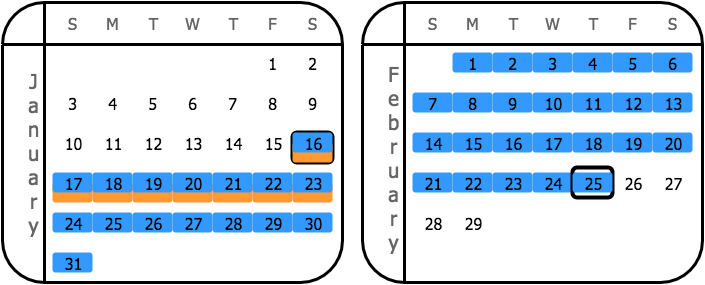

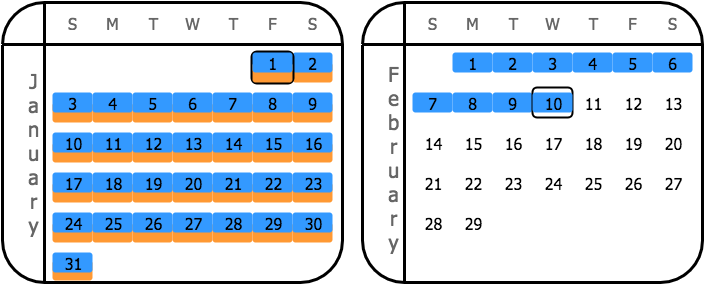

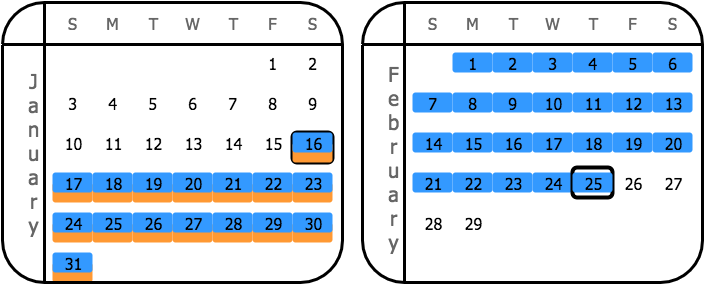

diagram is as follows:

+ : Starting and ending dates of the credit period

+ : Days of the credit period

+ : Days of the cash discount period

## Due date type: Fixed number of days

With the **Fixed number of days** calculation method, the payment is due a fixed number of days after the sale or purchase. You specify the number of days in **Due day 1**.

|Discount type|Sample settings|Result|

|---|---|---|

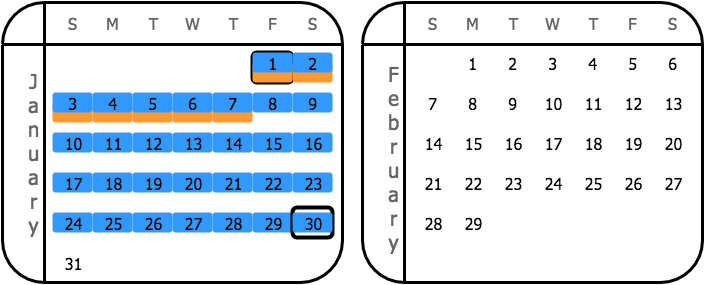

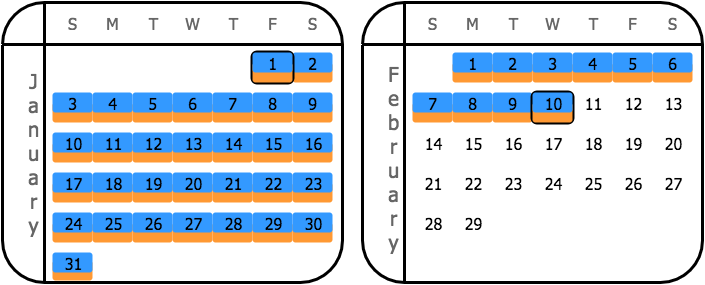

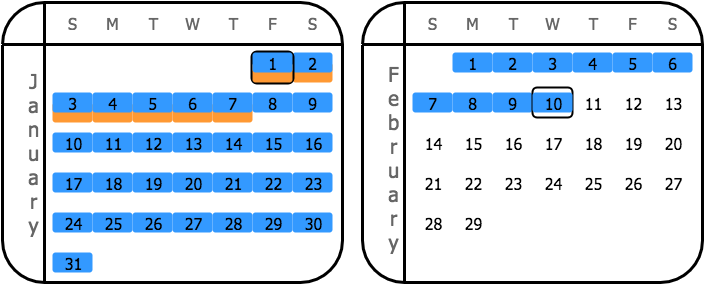

|**Fixed number of days**|In the Payment terms window: + **Due day 1**: **30** + **Discount day**: **7** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–1/31/2021 Cash discount period: 1/1/2021–1/8/2021 |

## Due date type: Day of next month

With the **Day of next month** calculation method, the payment is due on a particular day of the next calendar month after the month of the document date.

You specify the day in

**Due day 1**.

In this example, the value of the **Due day 1** parameter is greater than the number of days in the next month (February); therefore, the system uses the last date in the next month for the calculation of the credit period.

|Discount type|Sample settings|Result|

|---|---|---|

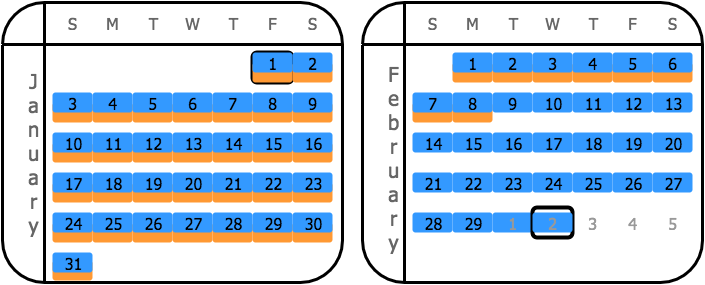

|**Day of next month**|In the Payment terms window: + **Due day 1**: **30** + **Discount day**: **7** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–2/7/2021 |

|**End of month**|In the Payment terms window: + **Due day 1**: **30** + **Discount day**: **N/A** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–1/31/2021 |

|**Day of the month**|In the Payment terms window: + **Due day 1**: **30** + **Discount day**: **7** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–1/7/2021 |

## Due date type: End of next month

With the **End of next month** calculation method, the payment is due at the end of the next calendar month after the month of the document date.

For this calculation method, note that the credit and cash discount periods are equal if the **End of next month** option is selected in the **Discount type** field.

|Discount type|Sample settings|Results|

|---|---|---|

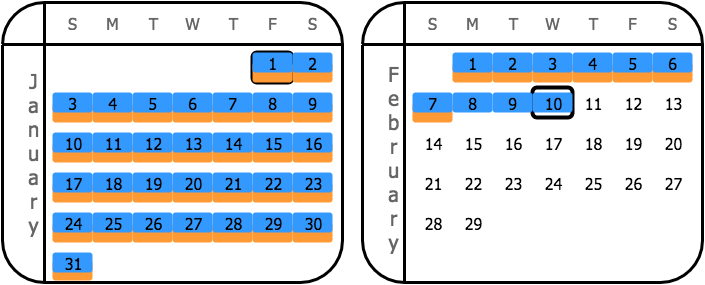

|**Day of next month**|In the Payment terms window: + **Due day 1**: **N/A** + **Discount day**: **7** in the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–2/7/2021 |

|**End of month**|In the Payment terms window: + **Due day 1**: **N/A** + **Discount day**: **N/A** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–1/31/2021 |

|**End of next month**|In the Payment terms window: + **Due day 1**: **N/A** + **Discount day**: **N/A** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–2/29/2021 |

|**Day of the month**|In the Payment terms window: + **Due day 1**: **N/A** + **Discount day**: **7** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–2/29/2021 Cash discount period: 1/1/2021–1/7/2021 |

## Due date type: Day of the month

With the **Day of the month** calculation method, the payment is due on a particular day of

the current calendar month, if the invoice is issued before this day.

If the invoice is issued

after this Day of the current calendar month, then the payment is due on the day of the next

calendar month.

You specify the day in **Due day 1**.

|Discount type|Sample settings|Result|

|---|---|---|

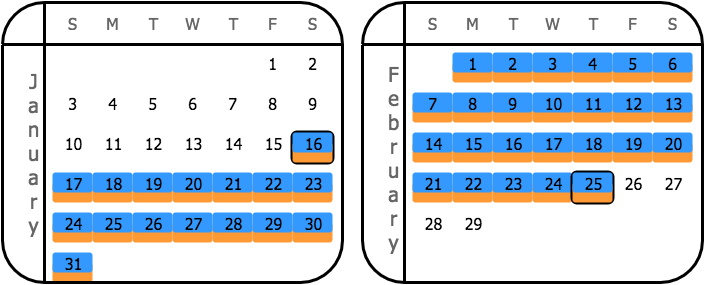

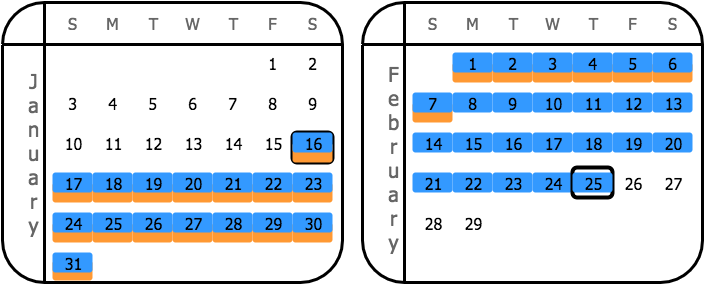

|**Day of the month**|In the Payment terms window: + **Due day 1**: **30** + **Discount day**: **7** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–1/30/2021 Cash discount period: 1/1/2021–1/7/2021 |

## Due date type: Fixed number of days starting next month

With the **Fixed number of days starting next month** calculation method, the payment is due a fixed number of days starting the first day of the next calendar month after a sale or purchase. You specify the number of days in **Due day 1**.

|Discount type|Sample settings|Result|

|---|---|---|

|**Fixed number of days starting next month**|In the Payment terms window: + **Due day 1**: **30** + **Discount day**: **7** In the document creation window: + **Document date**: **1/1/2021**|Credit period: 1/1/2021–3/2/2021 Cash discount period: 1/1/2021–2/8/2021 |

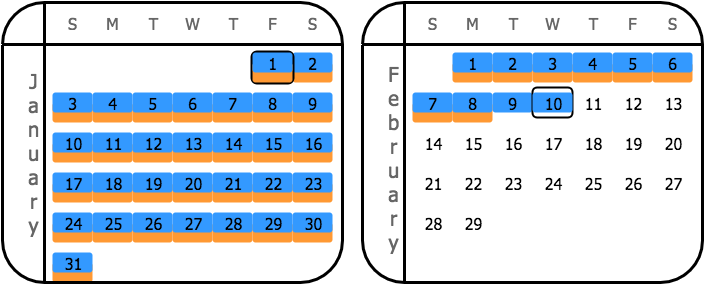

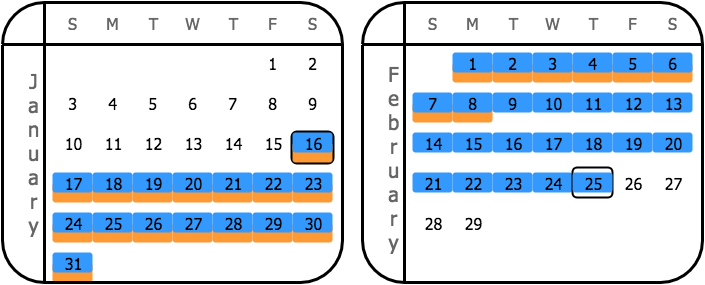

## Due date type: Custom

With the **Custom** calculation method, you set two time intervals for the document dates

and specify a due date for each interval.

The parameters for configuring the first interval are

**Due day 1**, **Day from 1**, and **Day to 1**, and the parameters for configuring the second interval are **Due day 2**, **Day from 2**, and **Day to 2**.

The sample settings here define the following intervals: 1–15 and 16–31.

The due

date for the first interval is the 10th of the next month for documents issued between day 1 and

day 15 of the current month.

The due date for the second interval is the 25th of the next month

for documents issued between day 16 and day 31 of the current month.

For this calculation method, note that the system shortens the cash discount period to be equal to the credit period if the **End of next month** option is selected as the **Discount type**.

|Discount type|Sample settings|Results|

|---|---|---|

|**Day of next month**|In the Payment terms window: Interval 1: + **Due day 1**: **10** + **Day from 1**: **1** + **Day to 1**: **15** Interval 2: + **Due day 2**: **25** + **Day from 2**: **16** + **Day to 2**: **31** **Discount day**: **7** In the document creation window: + **Document 1 date**: **1/1/2021** + **Document 2 date**: **1/16/2021**|### Document 1 Credit period: 1/1/2021–2/10/2021 Cash discount period: 1/1/2021–2/7/2021  ### Document 2 Credit period: 1/16/2021–2/25/2021 Cash discount period: 1/16/2021–2/7/2021 |

|**Fixed number of days**|In the Payment terms window: Interval 1: + **Due day 1**: **10** + **Day from 1**: **1** + **Day to 1**: **15** Interval 2: + **Due day 2**: **25** + **Day from 2**: **16** + **Day to 2**: **31** **Discount day**: **7** In the document creation window: + **Document 1 date**: **1/1/2021** + **Document 2 date**: **1/16/2021**|### Document 1 Credit period: 1/1/2021–2/10/2021 Cash discount period: 1/1/2021–1/8/2021  ### Document 2 Credit period: 1/16/2021–2/25/2021 Cash discount period: 1/16/2021–1/23/2021 |

|**End of month**|In the Payment terms window: Interval 1: + **Due day 1**: **10** + **Day from 1**: **1** + **Day to 1**: **15** Interval 2: + **Due day 2**: **25** + **Day from 2**: **16** + **Day to 2**: **31** **Discount day**: **N/A** In the document creation window: + **Document 1 date**: **1/1/2021** + **Document 2 date**: **1/16/2021**|### Document 1 Credit period: 1/1/2021–2/10/2021 Cash discount period: 1/1/2021–1/31/2021  ### Document 2 Credit period: 1/16/2021–2/25/2021 Cash discount period: 1/16/2021–1/31/2021 |

|**End of next month**|In the Payment terms window: Interval 1: + **Due day 1**: **10** + **Day from 1**: **1** + **Day to 1**: **15** Interval 2: + **Due day 2**: **25** + **Day from 2**: **16** + **Day to 2**: **31** **Discount day**: **N/A** In the document creation window: + **Document 1 date**: **1/1/2021** + **Document 2 date**: **1/16/2021**|### Document 1 Credit period: 1/1/2021–2/10/2021 Cash discount period: 1/1/2021–2/10/2021  ### Document 2 Credit period: 1/16/2021–2/25/2021 Cash discount period: 1/16/2021–2/25/2021 |

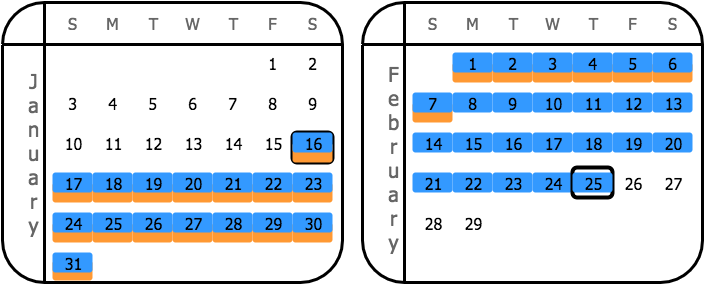

|**Day of the month**|In the Payment terms window: Interval 1: + **Due day 1**: **10** + **Day from 1**: **1** + **Day to 1**: **15** Interval 2: + **Due day 2**: **25** + **Day from 2**: **16** + **Day to 2**: **31** **Discount day**: **7** In the document creation window: + **Document 1 date**: **1/1/2021** + **Document 2 date**: **1/16/2021**|### Document 1 Credit period: 1/1/2021–2/10/2021 Cash discount period: 1/1/2021–1/7/2021  ### Document 2 Credit period: 1/16/2021–2/25/2021 Cash discount period: 1/16/2021–2/7/2021 |

|**Fixed number of days starting next month**|In the Payment terms window: Interval 1: + **Due day 1**: **10** + **Day from 1**: **1** + **Day to 1**: **15** Interval 2: + **Due day 2**: **25** + **Day from 2**: **16** + **Day to 2**: **31** **Discount day**: **7** In the document creation window: + **Document 1 date**: **1/1/2021** + **Document 2 date**: **1/16/2021**|### Document 1 Credit period: 1/1/2021–2/10/2021 Cash discount period: 1/1/2021–2/8/2021  ### Document 2 Credit period: 1/16/2021–2/25/2021 Cash discount period: 1/16/2021–2/8/2021 |

Related pages

Concepts

Tasks

Windows

Configure single-instalment payment terms

/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/configure-single-instalment-payment-terms

section

You use the Payment terms (CS206500) window to define each set of payment terms, including due dates and conditions for cash discounts when an outstanding balance is paid early.

2026-02-19T17:09:06+01:00

# Configure single-instalment payment terms

You use the Payment terms (CS206500) window to define each set of payment terms, including due dates and conditions for cash discounts when an outstanding balance is paid early.

For more information: [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/).

You use the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window to define each set of payment terms, including due dates

and conditions for cash discounts when an outstanding balance is paid early.

For a

set of payment terms, you can specify the payment as a single instalment (described

in this topic) or as multiple instalments (described in [Configure multiple-instalment payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/configure-multiple-instalment-credit-terms/)).

1. Go to the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window.

1. In the **General information** section, in the **Terms ID** field, type the ID of the payment terms. The ID may contain up to ten characters.

> [!NOTE]

> We do not recommend using any special symbols in the IDs of entities.

1. In the **Description** field, type the description of the terms.

1. In the **Visible to** field, select the visibility of these payment terms (that is, under what circumstances they are listed and available for selection). The following options are available:

+ **All**: The terms can be assigned to both suppliers and customers.

+ **Suppliers**: The terms can be assigned to suppliers only.

+ **Customers**: The terms can be assigned to customers only.

+ **Disabled**: The terms are removed from the selection lists for both suppliers and customers.

1. In the **Instalment type** field of the **Instalments settings** section, select **Single**.

1. In the **Due date type** field of the **Due day settings** section, select the due date type. For detailed descriptions of the options, see: [About payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/about-payment-terms/).

1. Depending on the due date type, specify the values of the other available elements (if any) in the **Due day settings** section.

1. Optional: In the **Cash discount settings** section, enter the settings that affect the discount for an early payment:

1. In the **Discount type** field, select the discount date type. The availability of options depends on the option selected as the **Due date type**.

1. In the **Discount day** field, specify the number of days or the particular day of the month, depending on the option selected in the **Discount type** field. (This field is unavailable for some **Discount type** options.)

1. In the **Discount %** field, specify the percent to be applied to the document total amount to calculate the discount percentage.

1. Click .

Configure multiple-instalment credit terms

/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/configure-multiple-instalment-credit-terms

section

You use the Payment terms (CS206500) window to define each set of payment terms.

2026-02-19T17:09:06+01:00

# Configure multiple-instalment credit terms

You use the Payment terms (CS206500) window to define each set of payment terms.

For more information: [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/).

You use the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window to define each set of payment terms.

For a set of payment terms, you can specify payment as a single instalment (described in [Configure single-instalment payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/configure-single-instalment-payment-terms/)) or as multiple instalments

(described in this topic).

1. Go to the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window.

1. In the **General information** section, in the **Terms ID** field, type the ID of the payment terms. The ID may contain up to ten characters.

> [!NOTE]

> We do not recommend using any special symbols in the IDs of entities.

1. In the **Description** field, type the description of the terms.

1. In the **Visible to** field, select the visibility of these payment terms (that is, under what circumstances they are listed and available for selection). The following options are available:

+ **All**: The terms can be assigned to both suppliers and customers.

+ **Suppliers**: The terms can be assigned to suppliers only.

+ **Customers**: The terms can be assigned to customers only.

+ **Disabled**: The terms are removed from the selection lists for both suppliers and customers.

1. In the **Instalment type** field of the **Instalments settings** section, select **Multiple**.

1. In the **Instalment method** field, select the instalment method, which determines how the system calculates the instalment amounts.

1. If you selected the **Equal parts** or **VAT in first instalment** instalment method, do the following:

1. In the **Number of instalments** field, type the number of instalments.

1. In the **Instalment frequency** field, select the instalment frequency.

1. If you selected the **Split by percent in table** method, do the following for each instalment:

1. In the **Instalments schedule** table toolbar, click ****.

1. In the **Days** column, type the number of days from the due date on which this particular instalment is due.

1. In the **Percent** column, type the percent of the instalment.

1. In the **Due date type** field of the **Due day settings** section, select the due date type. For detailed descriptions of the options, see: [About payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/about-payment-terms/).

1. Depending on the due date type, specify the values of the other available elements (if any) in the **Due day settings** section.

1. Click .

Disable credit terms

/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/disable-credit-terms

section

You use the Payment terms (CS206500) window to define each set of payment terms, as well as to change the target audience for which the terms are visible or disable a particular set of payment terms.

2026-02-19T17:09:06+01:00

# Disable credit terms

You use the Payment terms (CS206500) window to define each set of payment terms, as well as to change the target audience for which the terms are visible or disable a particular set of payment terms.

For more information: [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/).

1. Go to the [Payment terms (CS206500)](/visma-net-erp/help/common-settings/common-settings-windows/payment-terms-cs206500/) window.

1. In the **General information** section, in the **Terms ID** field, select the ID of the payment terms that you want to disable.

1. In the **Visible to** field, select the **Disabled** option.

1. Click .

Related pages

Concepts

Tasks

Windows

About credit verification

/visma-net-erp/help/customer-ledger/manage-credit-policy/about-credit-verification

page

Although accurate evaluation of customers' credit worthiness is required, employees may perform it outside of the system by gathering data on the financial health of potential customers, including their current credit score.

2026-02-19T17:09:06+01:00

# About credit verification

Although accurate evaluation of customers' credit worthiness is required, employees may perform it outside of the system by gathering data on the financial health of potential customers, including their current credit score.

In Visma Net, you can configure credit verification rules to prevent risky customers (such as those who pay too late) from accruing debts that cannot be paid.

## Credit verification application in the Customer ledger

Credit verification is invoked each time a user creates an invoice for a customer in Customer ledger.

When you create an invoice and the customer fails the credit check, the system checks the value of the **Hold documents on failed credit check** check box in the [Customer ledger preferences (AR101000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-ledger-preferences-ar101000/) window, which defines what happens to new invoices if the credit check fails:

+ If the check box is selected, you may save the document (invoice or debit note) with the **On hold** status, but the document cannot be released until the credit violation is resolved.

+ If the check box is cleared, you can save new documents with the **Balanced** status and process them regardless of the credit check result, although the system warns users about customers that have failed their credit check.

## Credit verification application in sales

If the Sales workspace is enabled, credit verification is invoked each time you create an invoice that originates in the Sales workspace. When you create an invoice by using the [Customer invoices (SO303000)](/visma-net-erp/help/sales/sales-windows/customer-invoices-so303000/) window and the customer fails the credit check, the system checks the value of the **Hold invoices on failed credit check** check box in the [Sales order preferences (SO101000)](/visma-net-erp/help/sales/sales-windows/sales-order-preferences-so101000/) window. This check box defines what happens to new invoices if the credit check fails:

+ If the check box is selected, the invoice gets the **Credit hold** status and can be saved with only the **Credit hold** or **On hold** status. For invoices with the **Credit hold** status, in the [Process sales invoices (SO505000)](/visma-net-erp/help/sales/sales-windows/process-sales-invoices-so505000/) window, you can perform the **Release from credit hold** action. When the action is completed, the system saves the invoice with the **Balanced** status and you can process it further.

+ If the check box is cleared, you can save new documents with the **Balanced** status and process them regardless of the credit check result, although the system warns users about customers that have failed their credit check.

Credit verification is invoked for orders that are based on an order type that has

the **Hold document on failed credit check** check box selected

in the [Order types (SO201000)](/visma-net-erp/help/sales/sales-windows/order-types-so201000/) window. For an order of such a

type, when you create a sales order and try to change the status of the sales order

to **Open**, the system performs a credit check of the customer, and if the

customer fails the credit check, the document gets the **Credit hold** status

(and can be saved with only the **Credit hold** or **On hold** status).

For

orders with these statuses, in the [Process orders (SO501000)](/visma-net-erp/help/sales/sales-windows/process-orders-so501000/) window, you can perform the **Release from credit hold** action. This

initiates credit checks for each order selected, and if the credit check is

successful, the order receives a status of **Open**.

## Credit verification rule setup

You can set credit verification rules for individual customers and for groups of

customers.

To provide default credit verification settings for groups of similar

customers, you can specify credit rules by customer class in the [Customer classes (AR201000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-classes-ar201000/) window.

If needed, you can

disable or redefine the default rules for individual customers by using the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window.

In the **Credit verification** field in these windows, you can select one of the following options:

Credit limit

: If the customer's total outstanding balance is greater than the amount specified in the **Credit limit** field, the system generates a warning. If the value in the **Over-limit amount** field is also exceeded, the system puts new invoices on hold or issues a warning, depending on the **Hold documents on failed credit check** setting and (if the Sales workspace is used) the **Hold invoices on failed credit check** setting.

Days past due

: Payment terms are defined and due dates are calculated based on the customer's terms. If the customer has a document that is past due by more days than the number of days past due specified in the **Credit days past due** field, the system puts new invoices on hold or issues a warning, depending on the **Hold documents on failed credit check** setting and (if the Sales workspace is used) the **Hold invoices on failed credit check** setting.

Limit and days past due

: Both types of rules are applied: The customer's debt should not exceed the credit limit, and the payment date should not exceed the due date of an invoice by more days than the specified number of days past due. If either rule is violated (or both rules are), the system puts new invoices on hold or issues a warning, depending on the **Hold documents on failed credit check** setting and (if the Sales workspace is used) the **Hold invoices on failed credit check** setting.

Disabled

: No credit rules are to be applied.

You can view the unused credit limit of a customer in the **Remaining credit limit** field on the **General settings** tab of the Customers window.

Related pages

Concepts

Windows

Overdue charges

/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges

section

2026-02-19T17:09:06+01:00

# Overdue charges

About overdue charges

/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charges

page

In Visma Net, you can set up the functionality that makes the system to calculate overdue charges and show them on customer statements to inform customers of additional charges they have incurred for documents that are past due.

2026-02-19T17:09:06+01:00

# About overdue charges

In Visma Net, you can set up the functionality that makes the system to calculate overdue charges and show them on customer statements to inform customers of additional charges they have incurred for documents that are past due.

You can define multiple overdue charge codes (particular overdue charge IDs) with their own rates and other settings that affect when and how overdue charges are applied. Thus, you can adjust Visma Net to fit your existing policies and any policies you want to implement in the future.

The system calculates overdue charges for all customer accounts for which overdue charges are assigned, except for accounts with the **Inactive** or **On hold** status in the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window.

This functionality is available only if the **Overdue charges** functionality is enabled in the [Enable/disable functionalities (CS100000)](/visma-net-erp/help/common-settings/enable-or-disable-functionalites/enable-disable-functionalities-cs100000/) window.

## Set up the overdue charge collection process

You perform the following steps to configure the collection and processing of overdue charges:

1. In the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window, you configure at least one overdue charge code, which defines the calculation method and the criteria for collecting charges. For details, see [About overdue charge code definition](/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charge-code-definition/).

1. In the [Customer classes (AR201000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-classes-ar201000/) window, you do the following for each customer class whose customers you want to be subject to overdue charge collection:

1. Select the **Apply overdue charges** check box.

1. Associate the overdue charge code you created with the customer class by specifying the code in the **Overdue charge ID** field.

When a new customer account is created in the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window and a customer class is selected, the customer class supplies the default value of the **Apply overdue charges** check box (on the **General info** tab). You can change this default value for any customer account. If the customer account is subject to overdue charge collection (that is, if this check box is selected for the customer), for all of the customer's debit documents, the system displays the **Apply overdue charge** check box on the **Financial details** tab of the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window. By default, the check box is selected, but you can clear the check box for a particular document.

The following options, located in the [Customer ledger preferences (AR101000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-ledger-preferences-ar101000/) window, affect all customers that are subject to overdue charges and can be set to fit your company's policies:

Apply payments to overdue charges first

: If this check box is selected, payments will be applied first to overdue charges and only then to outstanding invoices, starting with those having the earliest dates. Payment can be applied to a particular invoice only if the **Apply payments automatically** check box is selected for a customer in the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window.

Calculate on overdue charges documents

: If this check box is selected, overdue charges will be calculated on overdue charge documents as well as on invoices; thus, the amount of overdue charges compounds.

After configuration is done, you use the [Calculate overdue charges (AR507000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/calculate-overdue-charges-ar507000/) window to process the overdue documents of customer accounts that are associated with the statement cycle you select in this window. For details, see [Calculate overdue charges](/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/calculate-overdue-charges/).

## Set up the calculation of overdue charges by statement cycle

By default, the system uses the overdue charge code specified in the applicable customer class to calculate overdue charges. Alternatively, you can indicate to the system that the code should be taken from the applicable statement cycle to calculate charges.

Customer accounts are initially assigned the statement cycle, if any, specified for their customer class. But specifying a statement cycle in a customer class is not mandatory, as it is for a customer account. Additionally, for each customer, you may override the statement cycle that was assigned by default. Therefore, customer accounts within the same customer class may have different statement cycles.

You perform the following steps to set up overdue charge calculation by using the code specified in the statement cycle:

1. In the [Statement cycles (AR202800)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/statement-cycles-ar202800/) window, you specify an overdue charge code for each statement cycle used in the system. You may associate different codes with different statement cycles or use the same code for all statement cycles.

1. In the [Customer ledger preferences (AR101000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-ledger-preferences-ar101000/) window, you select the **Set default overdue charges by statement cycle** check box, to indicate to the system that the source of the overdue charge code is the statement cycle of the customer account.

After you have performed these configuration steps, the system will use the overdue charge code assigned to the applicable statement cycle to calculate overdue charges for customers and documents included in the charge collection process.

## Process overdue documents

You process the calculation of the overdue charges for the overdue documents (that is, invoices and debit notes) in the [Calculate overdue charges (AR507000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/calculate-overdue-charges-ar507000/) window. In this window, once you specify the criteria in the selection area, the system displays the documents that comply with the following requirements:

+ The customer of the document is subject to overdue charges or the **Apply overdue charges** check box is selected for the customer account in the **General info** tab of the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window.

+ The document is subject to overdue charges or the **Apply overdue charge** check box is selected for the document on the **Financial details** tab of the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window.

To run the calculation process, you click **Calculate** on the window toolbar. If the **Calculate on overdue charges documents** check box is cleared in the [Customer ledger preferences (AR101000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-ledger-preferences-ar101000/) window, the system calculates simple charges by doing the following:

+ Checking whether an invoice or a debit note is past due by using the associated credit terms

+ Calculating the charges for the days past due (if there are no previous overdue charges for the document)

+ Calculating the charges since the date of the last overdue charges (if overdue charges have been recorded for the document)

After the calculation is done, the system displays the list of overdue documents with the relevant details for each document, including the amounts of calculated overdue charges. You review the calculation results and process either the overdue documents you select (by using the unlabelled check boxes) or all of the documents by clicking either **Process** or **Process all** in the window toolbar.

The result of processing is a customer ledger document of the **Overdue charge** type with the **Balanced** status (or the **On hold** status if **Hold documents on entry** is selected in the [Customer ledger preferences (AR101000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-ledger-preferences-ar101000/) window).

If the system finds multiple overdue documents for the same customer account, it creates for this customer one document of the **Overdue charge** type that lists the charge amounts for each invoice.

You further process this document of the **Overdue charge** type by using the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window.

If the **Calculate on overdue charges documents** check box is selected in the [Customer ledger preferences (AR101000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customer-ledger-preferences-ar101000/) window, the system searches for documents of the **Overdue charge** type as well and calculates charge amounts the same way as it does for the invoices and debit notes.

## Release documents of the Overdue charge type

You release a document of the **Overdue charge** type by using the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window. When you release an overdue document, the system generates a batch with the general ledger transactions. One transaction debits the customer ledger account referred to in the original document (which is usually the default customer ledger account for the customer), and the other transaction credits the Overdue charges account specified in the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window for that charge, as shown in the following table.

|Account|Debit|Credit|

|---|---|---|

|Customer ledger account|Amount|0.0|

|Overdue charges account|0.0|Amount|

If the system finds an unreleased overdue charge document for an overdue document (among other overdue documents of the particular customer), this document is marked with an error and no new overdue charge document is created for overdue documents of this customer account. You can select this document and click **View last charge** to view and release the existing overdue charge document. Then you can calculate and process overdue charges for overdue documents of this customer account again.

Overdue charges may be numbered differently from invoices or notes. VAT are not calculated on overdue charges, and discounts are not applicable to overdue charges.

## Exclude a customer or a document from the charge collection process

To exclude a customer account from the charge collection process, you clear the **Apply overdue charges** check box for the customer account on the **General info** tab of the [Customers (AR303000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/customers-ar303000/) window.

To exclude a particular document from the process, you clear the **Apply overdue charge** check box for the document on the **Financial details** tab of the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window.

Note: This check box is displayed for the document only if the customer of the document is included in the charge collection process.

About overdue charge code definition

/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charge-code-definition

section

By using the Overdue charges (AR204500) window, you can create an unlimited number of overdue charge codes or particular overdue charge entities with their own rates and settings.

2026-02-19T17:09:06+01:00

# About overdue charge code definition

By using the Overdue charges (AR204500) window, you can create an unlimited number of overdue charge codes or particular overdue charge entities with their own rates and settings.

For more information: [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/).

By using the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window, you can create

an unlimited number of overdue charge codes or particular overdue charge entities with

their own rates and settings.

Overdue charges are applied in either the base currency or the

currency of the overdue document.

## Preliminary configuration steps

Before you start setting up overdue charge codes, you need to perform the following steps:

1. You create the following entities (or determine which existing entities you will use), which you need for collecting and recording the overdue charges:

+ A general ledger account of the **income** type and a corresponding subaccount (if applicable in your system) to record each overdue charge and each overdue fee, if you plan to charge one. You can use the same account for recording all overdue charges and overdue fees or create separate accounts for each overdue charge and each overdue fee. For details, see: [Add an account to the chart of accounts](/visma-net-erp/help/general-ledger/manage-chart-of-accounts/add-an-account-to-the-chart-of-accounts/).

+ Payment terms that provide a schedule for paying overdue charge documents. The payment terms used for overdue charges should be created without discounts. You can create just one set of payment terms for overdue charge documents or multiple sets. For details, see: [About payment terms](/visma-net-erp/help/customer-ledger/manage-credit-policy/payment-terms/about-payment-terms/).

1. You plan the overdue charge code or codes needed to suit your company's credit policy. The planning includes the following for each overdue charge code:

+ Selecting the calculation method to be used with the code

+ Deciding on the amount of the overdue charge

+ Deciding on the amount of the overdue fee, if you plan to charge one

+ Defining the criteria for creation of a document of the **Overdue charge** type for this code

The following sections provide detailed information about the settings of the overdue charge codes.

## Calculation methods

The system provides three calculation methods you can use to define the amount that is subject to overdue charges based on the number of days after the due date. The charges can be calculated either for open documents (those that are not fully paid) or for closed documents (those that are fully paid). The base all the methods use for calculation is the open balance of the overdue document.

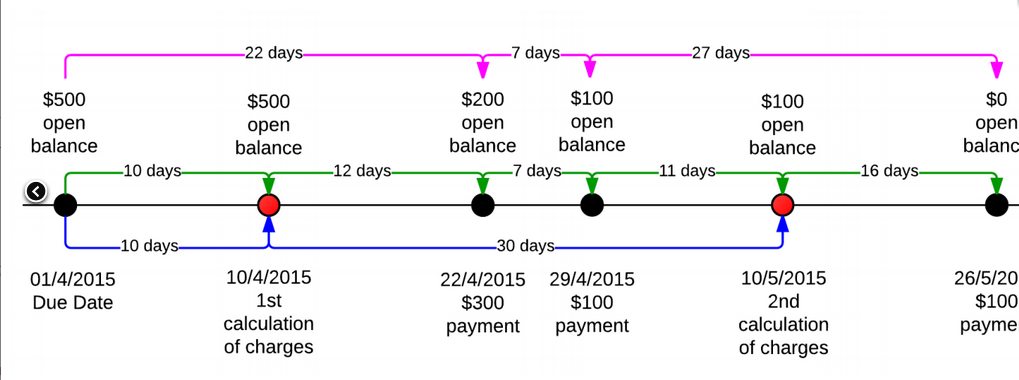

The figure below and the examples show how interest is calculated when you use the different calculation methods. Note that the examples are in US dollars.

For each overdue charge code, you select one of the following options in the **Calculation method** field in the Overdue charges window:

Interest on open entries

: :

The overdue document is subject to charges until it is closed. To calculate the charges for the days past due, the system uses the document’s open balance as of the date of calculation. If overdue charges have been recorded for the document, the system calculates the charges for the number of days since the date of the last overdue charges.

The system calculates overdue charges as follows (the blue lines in the related figure):

1. On the first calculation of charges, the system applies charges to the $500 open entries for 10 days overdue.

1. On the second calculation of charges, the system applies charges to the $100 open entries for 30 days overdue.

1. On the third calculation of charges, the system does not apply charges because the document is fully paid.

Interest on open, partially paid and paid entries

: :

The overdue document is subject to charges until it is closed. To calculate the charges for the days past due, the system uses the document’s open balance for each of these days. If overdue charges have been recorded for the document, the system calculates the charges for the number of days since the date of the last overdue charges.

The system calculates overdue charges as follows (see the green lines in the figure):

1. On the first calculation of charges, the system applies charges to the $500 for 10 days overdue.

1. On the second calculation of charges, the system applies the sum of charges to the $500 for 12 days overdue, to the $200 for 7 days overdue, and to the $100 for 11 days overdue.

1. On the third calculation of charges, the system applies charges to the $100 for 16 days overdue.

Interest on paid entries

: :

The overdue document becomes subject to charges the moment it is closed. To calculate the charges for the days past due, the system uses the document’s open balance for each of these days.

1. The system calculates overdue charges when the document is fully paid (the point when the charges are calculated for the third time in the figure).

1. The charges are the sum of charges applied to the $500 open balance for 22 days overdue, to the $200 open balance for 7 days overdue, and to the $100 open balance for 27 days overdue (the pink lines in the figure).

The calculation method is used along with the charging method, described in the next section of this topic, to determine how overdue documents are charged for a particular overdue charge code.

## Charging methods

A charging method defines how the system charges an overdue document. An overdue charge can be defined either as a fixed amount or as a percentage (annual rate) on an open balance for the number of days late. If the overdue charge is a percentage, the following formula is used to calculate overdue charges, based on the number of days past due.

```

Charge amount = (Percent rate) \* (Number of days past due) \* Open balance / (365 \* 100)

```

A percentage can be configured with a fixed minimum amount or a threshold amount.

If you

configure a percentage with a fixed minimum amount, the system charges an overdue document

for at least the fixed minimum amount. If you configure a percentage with a threshold

amount, the system charges a document only if the calculated charge amount is greater than

or equal to the threshold amount.

For details, see the following subsections of this topic:

### Charging a percentage with a minimum amount

If you define an overdue charge as a percentage on an open balance for the number of days late with a minimum amount specified, the system charges a document as follows:

+ If the charge amount is less than the specified minimum amount, the system charges the document for the minimum amount.

+ If the charge amount is greater than or equal to the specified minimum amount, the system charges the document for the calculated charge amount.

To charge a percentage with a minimum amount, in the **Charging settings** section in the Overdue charges window, you do the following:

+ In the **Charging method** field, you select the **Percent with min. amount** option.

+ In the **Min. amount** field (which appears once you have selected this charging method), you specify the minimum amount an overdue document should be charged.

+ In the **Total threshold** field, you specify the minimum amount of the overdue charge document; if the total amount of the lines of the overdue charge document is less than the total threshold amount, the document will not be created.

+ In the table (which appears once you have selected this charging method), you specify percent rate (or rates) with the date when the rate becomes effective.

### Charging a percentage with a threshold amount

If you define an overdue charge as a percentage on an open balance for the number of days late with a threshold amount specified, the system charges a document as follows:

+ If the charge amount is less than the specified threshold amount, the system does not charge the document.

+ If the charge amount is greater than or equal to the specified threshold amount, the system charges a document for the calculated charge amount.

To charge a percentage with a threshold amount, in the **Charging settings** section in the Overdue charges window, you do the following:

+ In the **Charging method** field, you select the **Percent with threshold** option.

+ In the **Threshold** field (which appears once you have selected this charging method), you specify the amount of charges that should define whether to charge a document.

+ In the **Total threshold** field, you specify the minimum amount of the overdue charge document; if the total amount of the lines of the overdue charge document is less than the total threshold amount, the document will not be created.

+ In the table (which appears once you have selected this charging method), you specify a percent rate (or rates) with the date when the rate becomes effective.

### Charging a fixed amount

An overdue charge can be defined as a fixed amount. To define an overdue charge as a fixed amount, in the **Charging settings** section in the Overdue charges window, you do the following:

+ In the **Charging method** field, you select the **Fixed amount** option.

+ In the **Amount** field (which appears once you have selected this charging method), you specify the fixed amount of the charge for overdue documents.

+ In the **Total threshold** field, you specify the minimum amount of the overdue charge document; if the total amount of the lines of the overdue charge document is less than the total threshold amount, the document will not be created.

Thus, if an open balance of an overdue document is greater than zero, the system charges the specified fixed amount.

## Overdue fee

Some companies charge a fixed amount (a fee) for processing documents of the **Overdue charge** type.

In these cases, a customer must pay the fee amount in addition to the

amount of calculated overdue charges.

A fee is charged for each overdue charge document. An additional line with the fee amount is added to the document.

If your company charges a fee for processing late documents, in the Overdue charges (AR204500) window, for any overdue charge code, specify the following settings:

Fee amount

: The fixed amount to be charged for a document of the **Overdue charge** type. A customer pays the amount in addition to the amount of the overdue charges.

Fee account

: ( **Fee subaccount** ): The account (and subaccount, if applicable) to which fee amounts are recorded.

You can leave these fields empty if your company does not charge fees for overdue charge documents.

Related pages

Concepts

Tasks

Windows

About the criteria for creating an overdue charge document

/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-the-criteria-for-creating-an-overdue-charge-document

page

The processing of overdue documents creates documents of the Overdue charge type.

2026-02-19T17:09:06+01:00

# About the criteria for creating an overdue charge document

The processing of overdue documents creates documents of the Overdue charge type.

When the system finds a customer's overdue document, the system adds this document as a line item to the document of the **Overdue charge** type (which is created once any overdue document is found). If the system has found multiple overdue documents of a customer, the system creates a document of the **Overdue charge** type with multiple lines. These documents of the **Overdue charge** type, also referred to as overdue charge documents, can be viewed in the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window.

You can set up a threshold amount that defines the amount of charges that should initiate the generation of an overdue charge document. You specify this threshold amount in the **Total threshold** field in the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window.

> [!NOTE]

> The overdue fee is not included in the overdue charge document amount that is compared to the threshold.

With the total threshold specified, the system decides whether to create an overdue charge document as follows:

1. It finds an overdue document of a customer or multiple documents of the customer.

1. It calculates the charge amount for each overdue document it found.

1. It compares the total amount of the calculated charges to the threshold amount, and then the system proceeds as follows:

+ If the total amount is greater than the threshold amount, the system creates an overdue charge document for the customer.

+ If the total amount is less than the threshold amount, the system does not create an overdue charge document for the customer.

For example, suppose that your company collects overdue charges only if the charge amount is greater than €10; you thus specify 10 in the **Total threshold** field. Further suppose that your company charges a fixed charge amount of €1. If a customer has at least 10 overdue documents, the system will create an overdue charge document to debit the customer account. If your company instead charges an annual rate, the system behaves in the same way. If the total of calculated percentages for a customer's overdue documents is greater than €10, the system creates an overdue charge document for the customer.

In addition to setting a threshold for the overdue charge amount, you can set a minimum amount and a threshold amount for adding a document as a line to the overdue charge document. You can configure the line threshold for only a charge that is defined as a percentage. To do this, you set up an overdue charge code on the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window and specify the **Charging a percentage with a minimum amount** or **Charging a percentage with a threshold amount** charging method. For details, see [About overdue charge code definition](/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charge-code-definition/).

## Overdue fee collection

You may want to charge your customers an additional fee each time overdue charges are

calculated.

In the **Overdue fee settings** section of the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window, you can specify the amount of the overdue fee and the account

and subaccount to register the collected fee to.

The fee is recorded as a separate line in the document of the **Overdue charge** type in the [Sales invoices (AR301000)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/sales-invoices-ar301000/) window.

Related pages

Concepts

Tasks

Windows

Example of how to apply calculation methods

/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/example-of-how-to-apply-calculation-methods

page

This topic provides examples of the overdue charge calculation methods that can be set in the system.

2026-02-19T17:09:06+01:00

# Example of how to apply calculation methods

This topic provides examples of the overdue charge calculation methods that can be set in the system.

Suppose that a customer's invoice is due on April 1; its open balance is €500 as of the due

date.

The customer paid the invoice after the due date with three payments: €300 on April 22,

€100 on April 29, and €100 on May 26.

The system calculates overdue charges on the 10th day of

each month.

The overdue charge amount is an annual rate of 10% and no thresholds are configured.

The system calculates the overdue charges differently, as described in the following sections of this topic, depending on the calculation method set for the overdue charge code in the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window.

## Interest on balance

If you select **Interest on balance** in the **Calculation method** field in the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window, the system calculates the overdue charges as follows:

1. On the first calculation of overdue charges, the system applies overdue charges to the €500 open balance for 10 days overdue and creates an overdue charge document in the amount of 0.1 \* 10 \* €500 / 365 = €1.37.

1. On the second calculation of overdue charges, the system applies overdue charges to the €100 open balance for 30 days overdue and creates an overdue charge document in the amount of 0.1 \* 30 \* €100 / 365 = €0.82.

1. On the third calculation of charges, the system does not apply overdue charges because the document is fully paid.

Overall, the system debited the customer's account for an additional €2.19 in overdue charges.

## Interest on prorated balance

If you select **Interest on prorated balance** in the **Calculation method** field in the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window, the system calculates the overdue charges as follows (see the green lines in the figure above):

1. On the first calculation of overdue charges, the system applies overdue charges to the €500 open balance for 10 days overdue and creates an overdue charge document in the amount of 0.1 \* 10 \* €500 / 365 = €1.37.

1. On the second calculation of overdue charges, the system applies the sum of charges to the €500 open balance for 12 days overdue, to the €200 open balance for 7 days overdue, and to the €100 open balance for 11 days overdue; it then creates an overdue charge document in the amount of (0.1 \* 12 \* €500 / 365) + (0.1 \* 7 \* €200 / 365) + (0.1 \* 11 \* €100 / 365) = €1.64 + €0.38 + €0.3 = €2.32.

1. On the third calculation of charges, the system applies overdue charges to the €100 open balance for 16 days overdue and creates an overdue charge document in the amount of 0.1 \* 16\* €100 / 365 = €0.44.

Overall, the system debited the customer's account for an additional €4.13.

## Interest on arrears

If you select the **Interest on arrears** option in the **Calculation method** field in the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window, the system calculates overdue charges when the document is fully paid (in the figure, the point when the charges are calculated for the third time).

The overdue charges are the sum of charges applied to the €500 open balance for 22 days

overdue, to the €200 open balance for 7 days overdue, and to the €100 open balance for 27 days

overdue.

The system creates an overdue charge document in the amount of (0.1 \* 22 \* €500 / 365)

\+ (0.1 \* 7 \* €200 / 365) + (0.1 \* 27 \* €100 / 365) = €3.01 + €0.38 + €0.74 = €4.13.

Overall, the system debited the customer's account for an additional €4.13.

Related pages

Concepts

Tasks

Windows

Configure an overdue charge code

/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/configure-an-overdue-charge-code

section

In this window, you configure an overdue charge code that defines the calculation method, the criteria of collecting charges, and the type of charge collection (fixed amount or percentage).

2026-02-19T17:09:06+01:00

# Configure an overdue charge code

In this window, you configure an overdue charge code that defines the calculation method, the criteria of collecting charges, and the type of charge collection (fixed amount or percentage).

1. Go to the [Overdue charges (AR204500)](/visma-net-erp/help/customer-ledger/customer-ledger-windows/overdue-charges-ar204500/) window.

1. Click  add a new code.

1. In the **Overdue charge ID** field, type an ID for your code. Have a look at the existing codes before you decide on a number or text, so that you don't use the same as an existing ID. You can use both numbers and letters.

1. Optional: Enter a **Description** and select a **Calculation method**. For more information about each calculation method, see [About overdue charges](/visma-net-erp/help/customer-ledger/manage-credit-policy/overdue-charges/about-overdue-charges/).

1. In the **Terms** field, select the terms for the payment.

1. Optional: select the **Base currency** check box if you want the system to calculate the overdue charge by using the base currency.

1. In the **Overdue charge account** field, select an overdue charge account.

1. In the **Overdue charge subaccount** field, press **F3** to choose a subaccount. If you do not use subaccounts, press and hold 0 until all sections in the field are filled.

1. Optional: In the **VAT code** field, select the VAT category.

1. Optional: If your company charges an overdue fee, in the **Overdue fee settings** section, enter the following details:

+ In the **Fee amount** field, type the amount of the overdue fee.

+ In the **Fee account** field, specify the account to which the overdue fee should be recorded.

+ In the **Fee subaccount** field, specify the subaccount to which the overdue fee should be recorded.