Client with deviating fiscal years

In Period & Year, deviating fiscal years are only solved with one client, which is used both for preparing annual financial statements and later submission of tax information. This is in contrast to Total, which used two different clients to achieve the same.

Steps

Submission of tax information based on previously prepared annual financial statements (2022/2023)

This step consists of:

- Importing previous information from Finale or Total in the start guide

- Verification / adjustment of tax information

- Submission of tax return and business specification

If this step is to be carried out, it is necessary for it to be completed BEFORE the preparation of a new annual financial statement begins.

Preparation of a new year-end closing (2023/2024)

This step consists of:

- Locking of previous year-end closing

Before starting the process for 2023/2024, the existing annual financial statements (2022/2023) must be locked. This is done on the start page. It can be unlocked later if necessary.

- Setting ERP source and importing 2024

If Finale or Total were used as the data source for the 2023 annual financial statements, a new ERP system must now be specified, for example, Visma Business. Then, you can import via the import button on the start page.

The ERP system defines the subsequent fiscal year upon import. It is therefore assumed that the ERP contains the correct definition of the fiscal year, for example, 01.03.2023 - 29.02.2024. If the ERP does not contain the correct fiscal year and this cannot be adjusted, file-based Excel import must be used instead. The fiscal year's division (date from to) is specified there.

Read more about Import accounting data.

- Year rotation of historical data

During the initial setup of the year-end closing after importing ERP data, the year rotation of historical data from the previous year's year-end closing will be performed. This process may take some time and occurs in the background after entering the client.

- Preparation of year-end closing

The preparation of year-end closing is carried out in the usual manner.

Read more about Information and tax for impersonal company category.

- Submission of annual reports

Submission of annual report is done in the usual manner once the year-end closing is finalized.

Further future work with tax returnWhen the Tax Administration has completed the tax return and industry specification for 2024 at a later date (in January 2025), and Period & Year opens for the submission of this, the same client that has been worked on should also be used for this purpose."

An upgrade of the tax images to the 2024 version will then be performed. In normal cases, this will happen automatically, but some control work should be expected to ensure that areas that have been revised by the Tax Administration remain correct after the upgrade. Additionally, any program enhancements in Period & Year for the new annual version may have some impact."

Transition from/to deviating fiscal year

There are different regulations related to the length of fiscal years in annual financial statements and tax returns/industry specifications. Even if the fiscal year of the entity exceeds 12 months, the industry specification cannot cover more than 12 months. This means that the entity, in such cases, must submit an industry specification even if an annual financial statement has not been established.

View various examples at the Tax Administration here: Avvikende regnskapsår – Når må det sendes søknad til Skattedirektoratet?

In Period & Year, fiscal years must be divided so that both necessary tax returns/industry specifications and annual financial statements can be prepared.

When preparing annual financial statements, if desired, numerical information from different fiscal years can be combined in the presentation.

Example from calendar year to deviating

| Period | Type |

|---|---|

| 01.01.2022 - 31.12.2022 | Calendar year |

| 01.01.2023 - 28.02.2023 | Short year |

| 01.03.2023 - 28.02.2024 | Deviating |

Example from deviating to calendar year

| Period | Type |

|---|---|

| 01.10.2022 - 30.09.2023 | Deviating |

| 01.10.2023 - 31.12.2023 | Short |

| 01.01.2024 - 31.12.2024 | Calendar year |

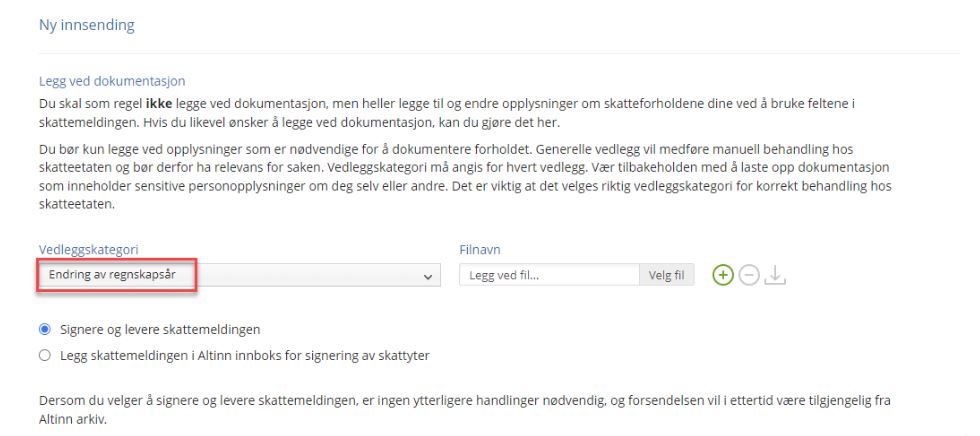

When submitting the tax return for the short transition period, it is important to include an attachment under the category 'Change of fiscal year,' so that the Tax Administration can differentiate between these and years of more ordinary length.

Read more about Deviating fiscal year.