February 2024

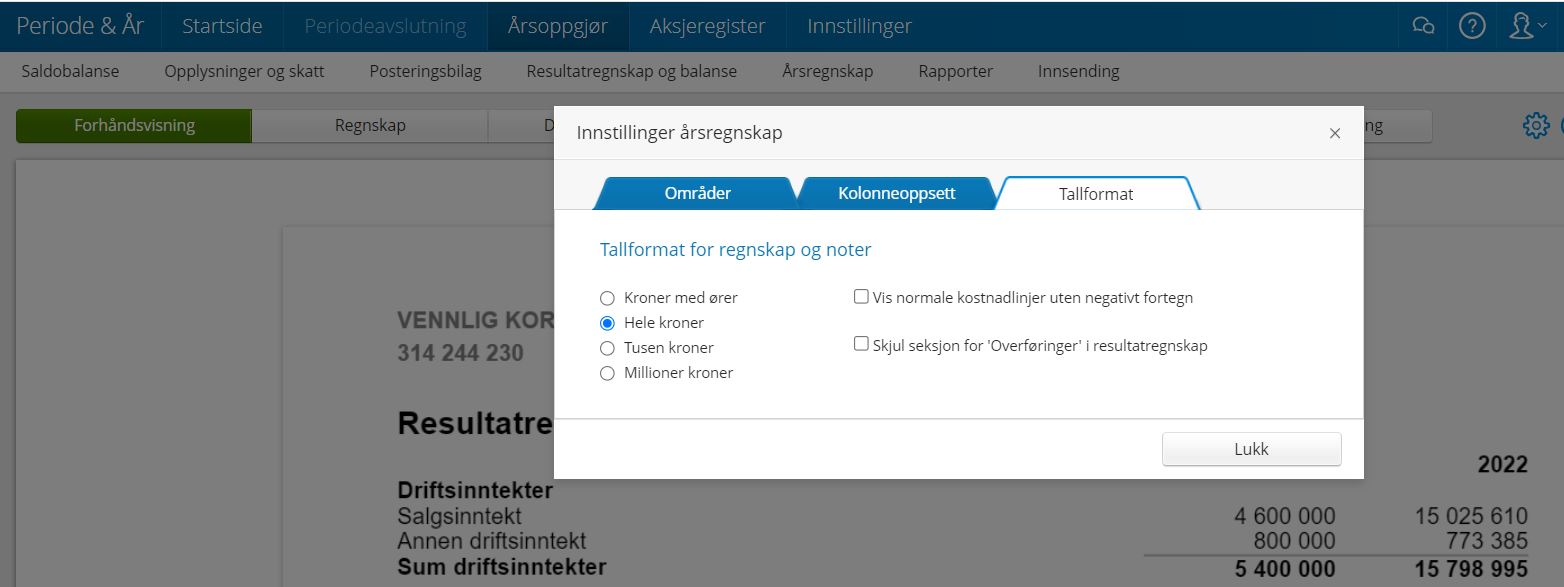

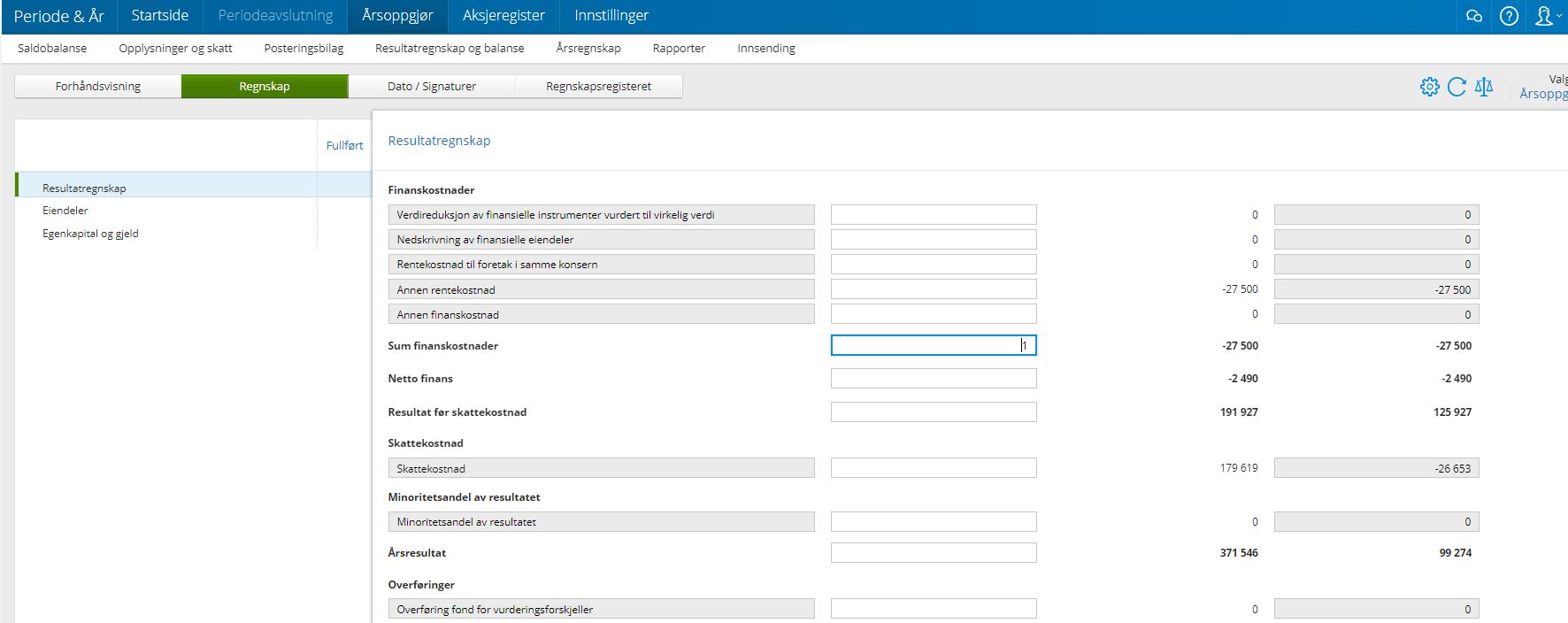

New features in annual report

- Download cashflow to Excel

- Possible to display normal cost lines without negative sign

- Hide the section for ‘Appropriations’ in the income statement

- New column for ‘No registered capital increase’ in the Equity note

- Possible to map a note to a sum line in the financial statement.

Read more about Annual report.

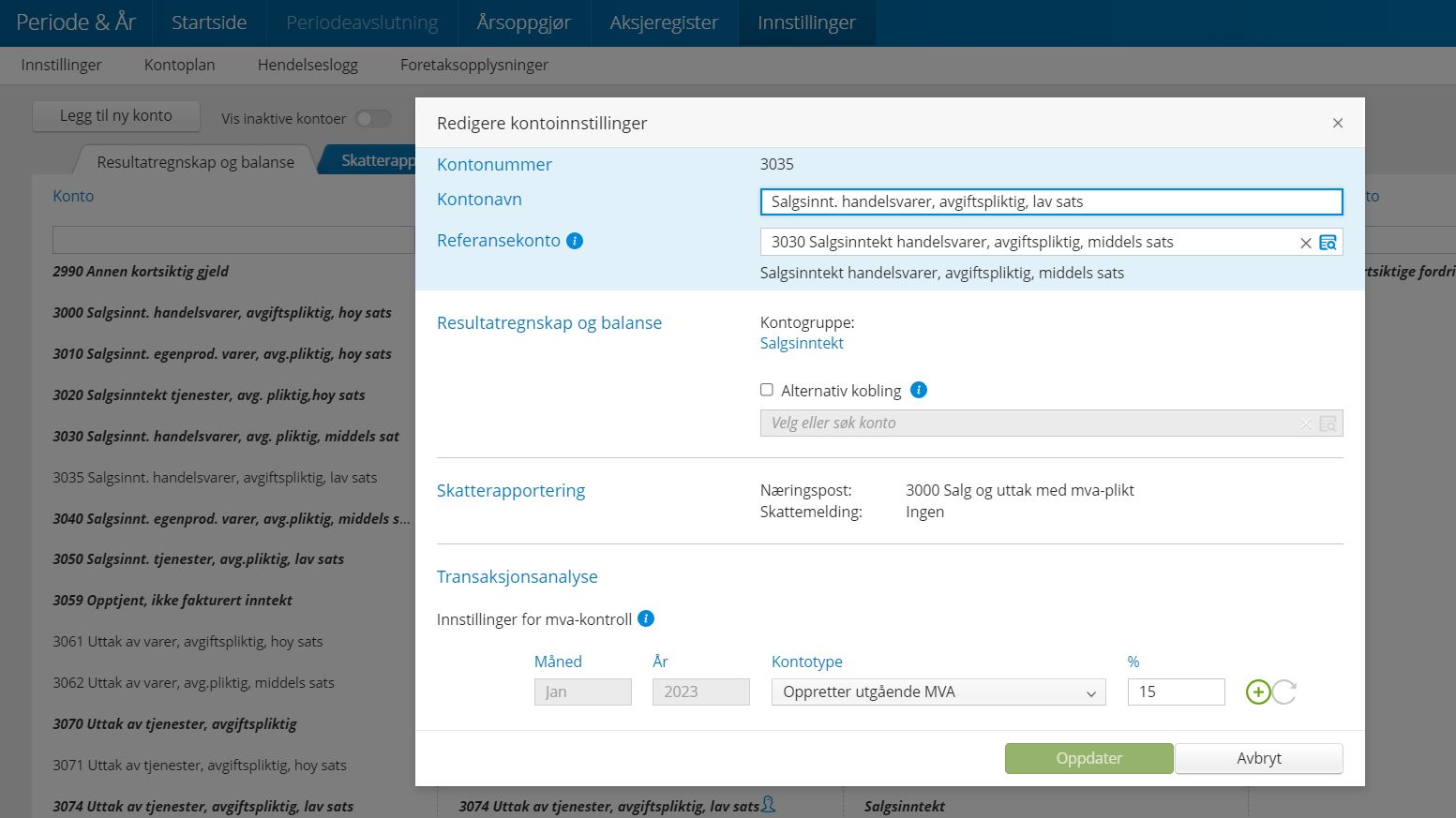

Chart of accounts - improvements when editing an account

- Possible to edit imported account names. The name is overwritten at the next import, so it is important to update to the correct name in ERP as well.

- If you have a five-digit account plan (or more), it is now possible to create new accounts in Period & Year.

Support for new company types

- Impersonal - Other business enterprise in accordance with special legislation

- Participant taxed (ANS, DA, KS etc) - Joint ownership according to the law of property

Import from Altinn/Total/Finale - edit balance balance

It is now possible to edit imported balances for 2022 after importing from Total, Finale or Altinn. Click Edit balances under Import status to move the imported balance to another account.

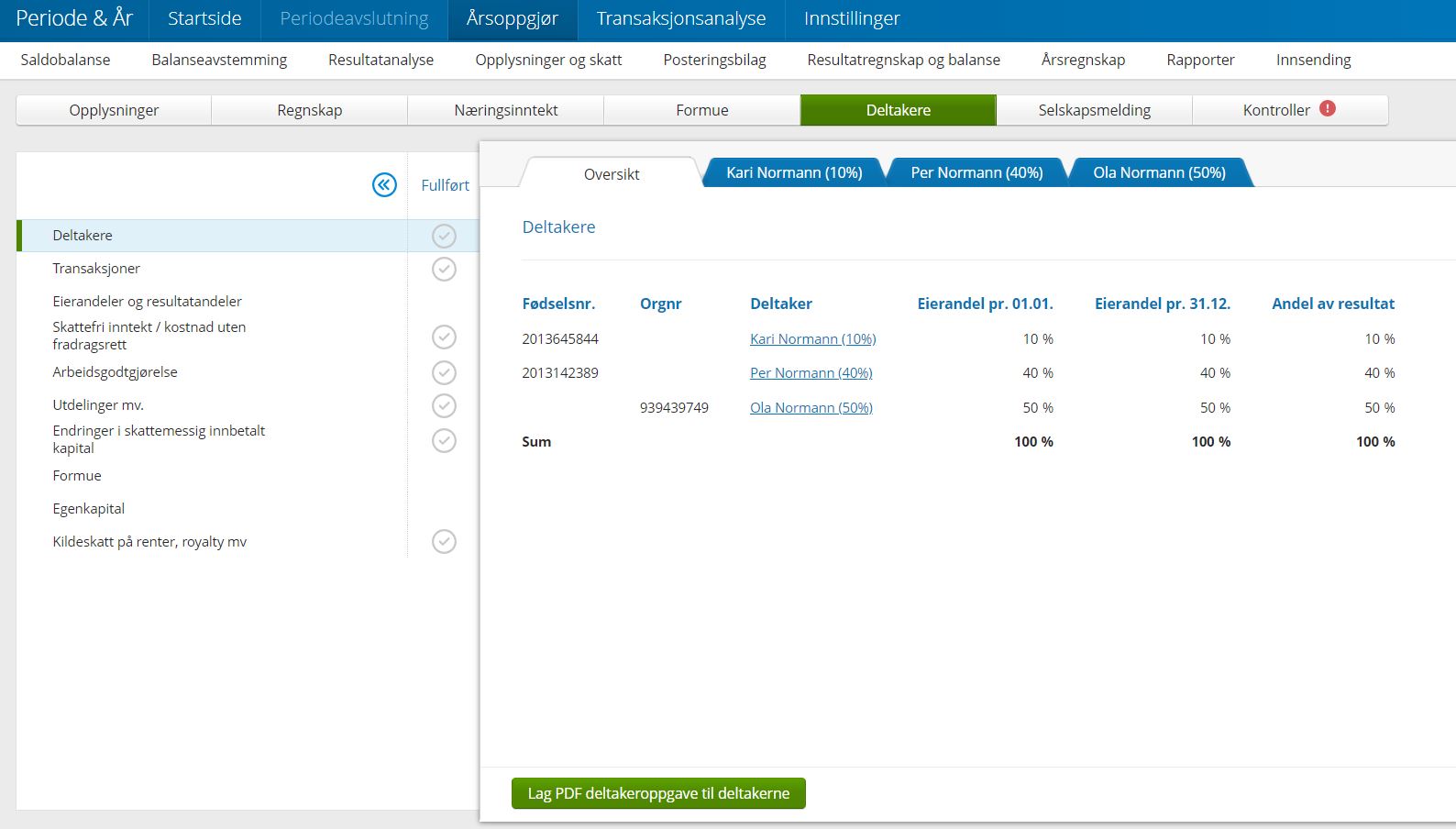

Participant taxed (ANS, DA, KS etc) - generate PDF for participants

It is now possible to generate a participant report with an overview of the participant’s income and assets.

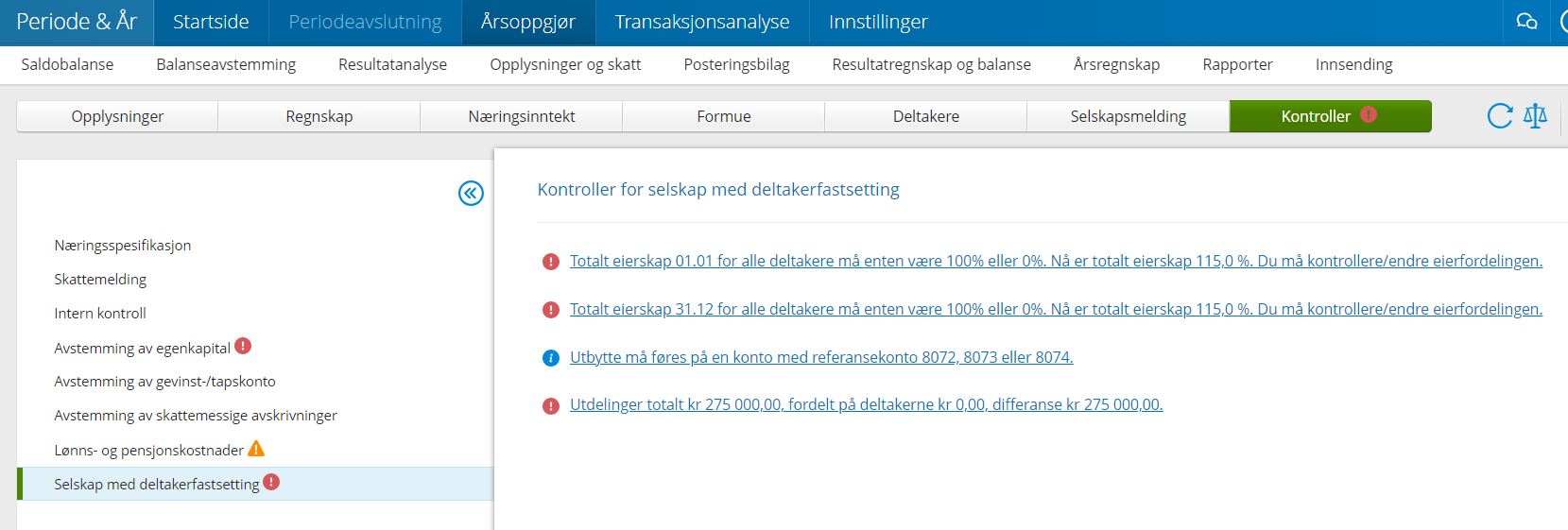

Participant taxed (ANS, DA, KS etc) - improved validation for owners

In Checks - Participant taxed company, new validations have been added on for example valid distribution and ownership.

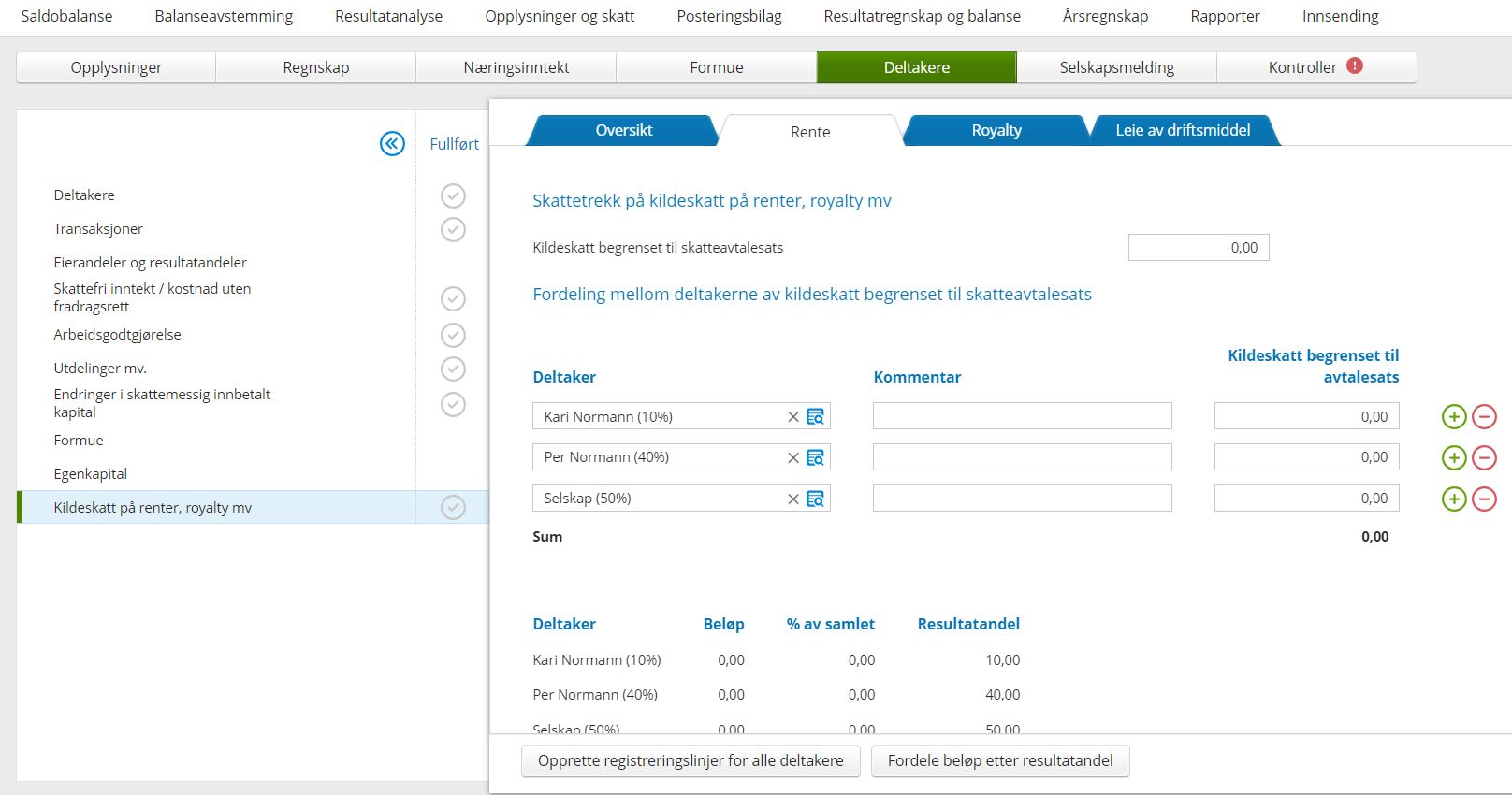

Participant taxed (ANS, DA, KS etc) - source tax on interest, royalties, etc

New menu item for automatic distribution of participant’s withholding tax on interest, royalties etc. after profit share is available in Participants - Source tax on interest, royalties, etc.

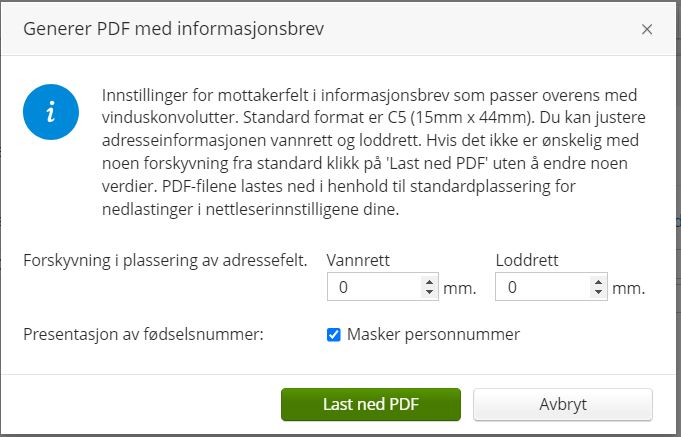

Information letter/annual statement - mask social security number

It is now possible to mask social security numbers when generating Information letter/annual return’ to PDF for third-party information or participant report.

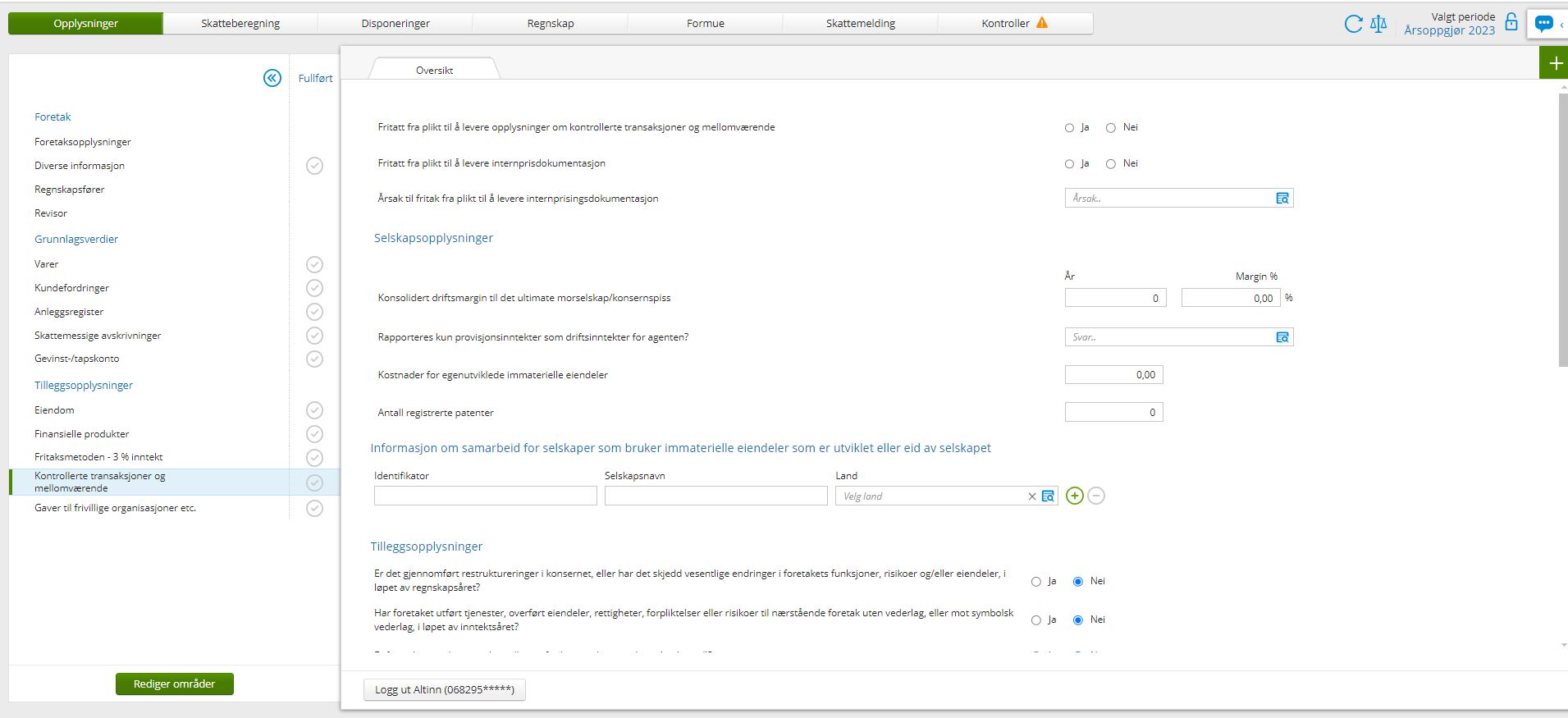

Additional information - support for controlled transactions and balances

If the company has transactions or balances with related parties above the amount limits, after logging in with the Tax Administration it is now possible to register values and receive updated calculations under Year-end closing - Information and tax - Information - Additional information - Controlled transactions and balances.

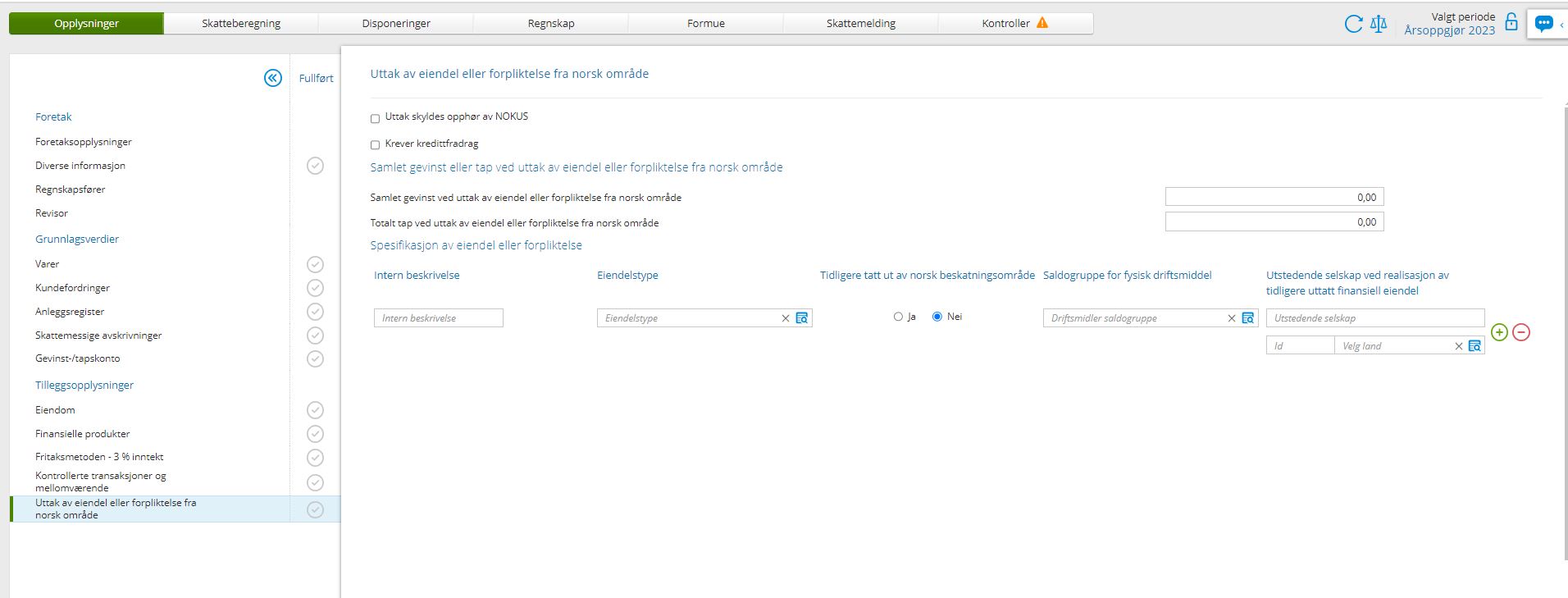

Additional information - support for discharge of asset or liability from Norwegian territory

A new area for registration of withdrawal of assets and liabilities from Norwegian taxation area is available under Year-end closing - Information and tax - Information - Additional information - Discharge of asset or liability from Norwegian territory.

Interest limitation - support for exemption rule

The area for interest limitation has been extended with support for the exemption rules.

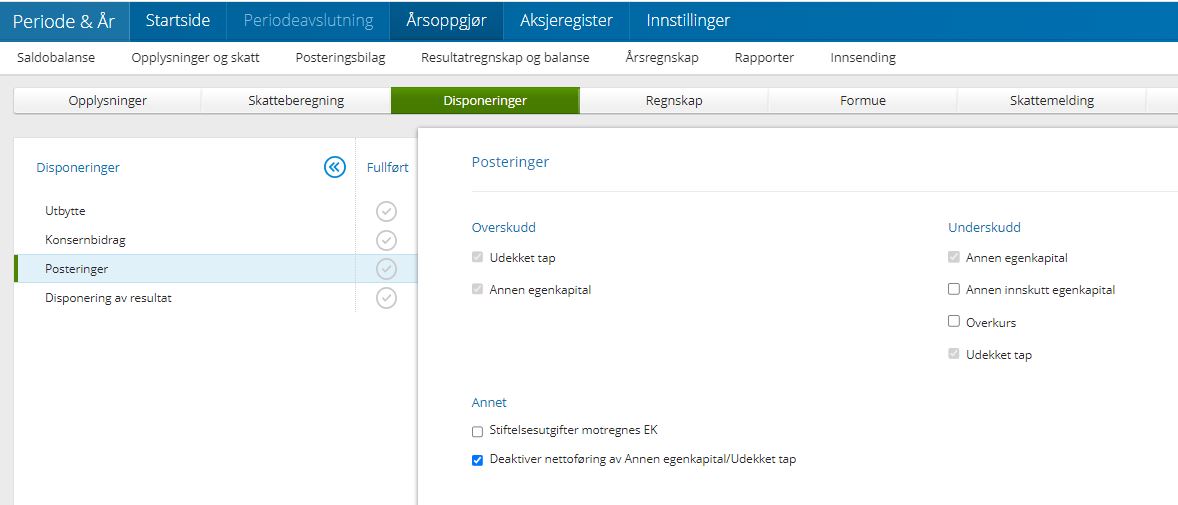

Allocations - deactivate netting of other equity/uncovered loss

In Allocations - Postings, it is now possible to deactivate netting of other equity/uncovered loss in the system posting for ‘Adjustment of other equity and allocation of the year’s profit’.

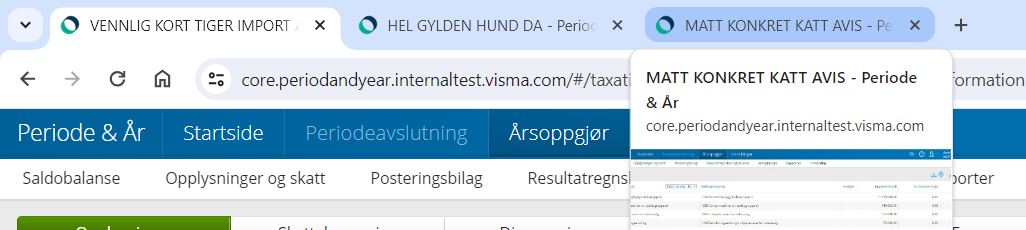

Clients - show client name on the browser tab

To ease working with multiple clients at the same time you can now see the name of the client in the browser tab.

Other improvements

In addition to all this, improvements have been made related to opening for the submission of tax return 2023 to the Tax administration, but also many smaller adjustments in other areas in Period & Year.