February 2025

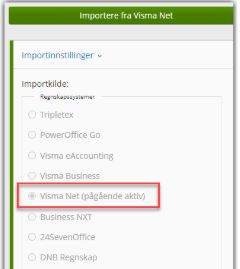

ERP integration - import of acconting data from Visma Net

In import settings it is now possible to select Visma Net as import source.

The integration for this system is based on chart of accounts and transactions.

It is also possible to transfer manually created and system-generated closing entries from Period & Year to Visma Net.

Read more about Import av regnskapsdata.

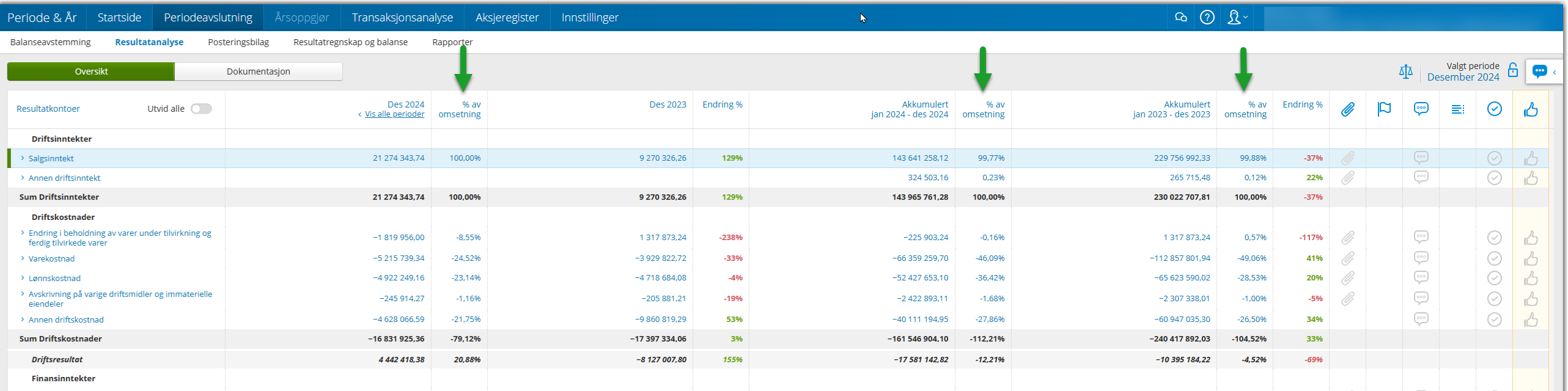

Reconciliation - new key figures column in Analysis IS

New columns has been added in Analysis IS to show percentage of total revenue.

Reconciliation - improvements in display of comments and checklist

It is now possible to keep the Comments and checklist area pinned when you navigate in Period & Year.

We also added a new ‘speech bubble icon’ to indicate that there are comments from previous periods.

Basic values - cooperative

As of year-end closing 2024, changes have been made to the work area Cooperative.

- Allocation of surplus to member capital account: A new field has been introduced where parts of the year’s deduction limit can be allocated to the member capital account for payment in later years.

- Payments from member capital account cf. Tax Act §10.50 5 paragraph:

- New manual field where you can enter payments from previous years’ allocations to member capital account.

- The field also has a new calculated field that shows how large a portion of the payment is, if any, not deductible

- Payments from post-payment funds: New manual field where you can enter non-deductible payments from post-payment funds

- Carry-forward deduction limit from previous years: New manual field where you can enter the available deductible amount for payments from member capital accounts from previous years.

- New calculations:

- New calculation of Additional income for non-deductible backpayment from the year’s profit

- New calculation of carry-forward deduction limit to later years

Tax return/Company tax return - open for submission 2024

Impersonal (limited liability company, etc) and Participant taxed (ANS, DA, KS, etc) can now submit tax return/company tax return to The Norwegian Tax Administration.

Liquidation/advance determination - open for income year 2025

If a company is to be liquidated in the income year 2025, you can now make a preliminary determination and liquidation of the company in Period & Year.

Basic values - interest limitation for group companies

As of year-end closing 2024, changes have been made to the work area Interest limitation. The changes apply to companies in a group.

Group contribution chain: In general, a requirement has been introduced for reporting the group contribution structure if the company has received group contributions with tax effect directly or indirectly from companies that are exempt from the interest limitation or use the exception rule? The field: “Deduction for group contributions that shall not be included in the calculation basis” has now become a calculated field from The Norwegian Tax Administration and is no longer manually fillable.

Corrected interest amount: New calculated field from the tax authorities under the area “The year’s addition or deduction in income” This concerns the rule change in the Tax Act § 6-41 ninth paragraph, which applies to companies in a group when total interest in the Norwegian part of the group does not exceed NOK 25,000,000 or the exception rule is used.