March 2024

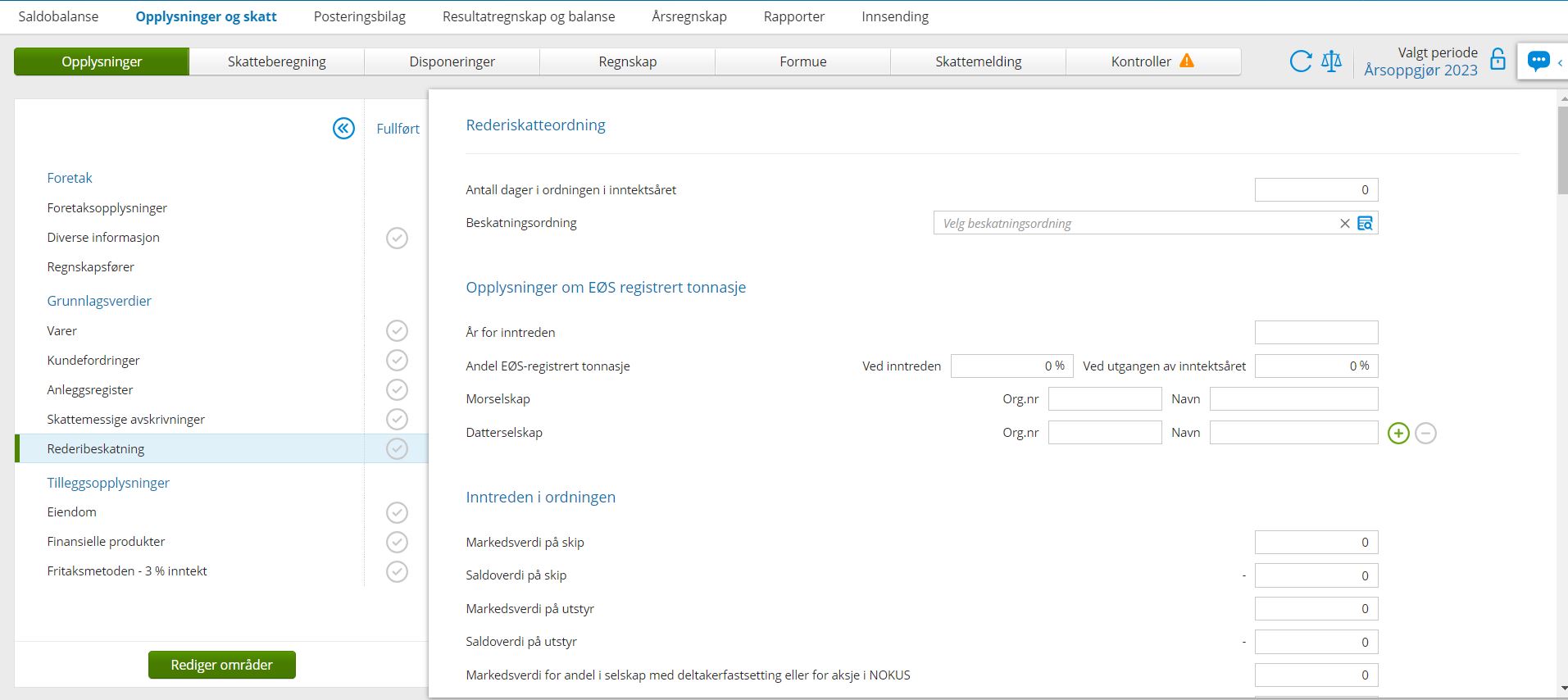

Basis values - support for shipping company taxation

A new area for registration of Shipping company taxation is available in Year-end closing - Information - Basis values for company category impersonal. The area is automatically displayed based on information in Various information - Shipping company.

Read more about Shipping company taxation.

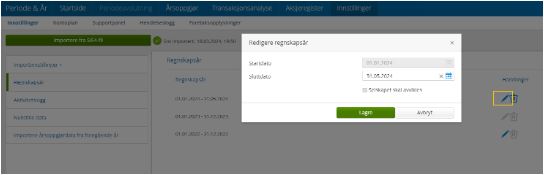

Liquidation/advance determination - open for income year 2024

If a company is to be liquidated in the income year 2024, you can now make a preliminary determination and liquidation of the company in Period & Year. This is done in Settings - Financial year. Click on the pen icon for the period to be liquidated, enter the current end date and check the box for The Company to be liquidated. Please note that periods after the specified date will be deleted permanently.

Note that if last year’s tax return has not been submitted, this period will also have to be determined in advance to be in the same run as the liquidation period.

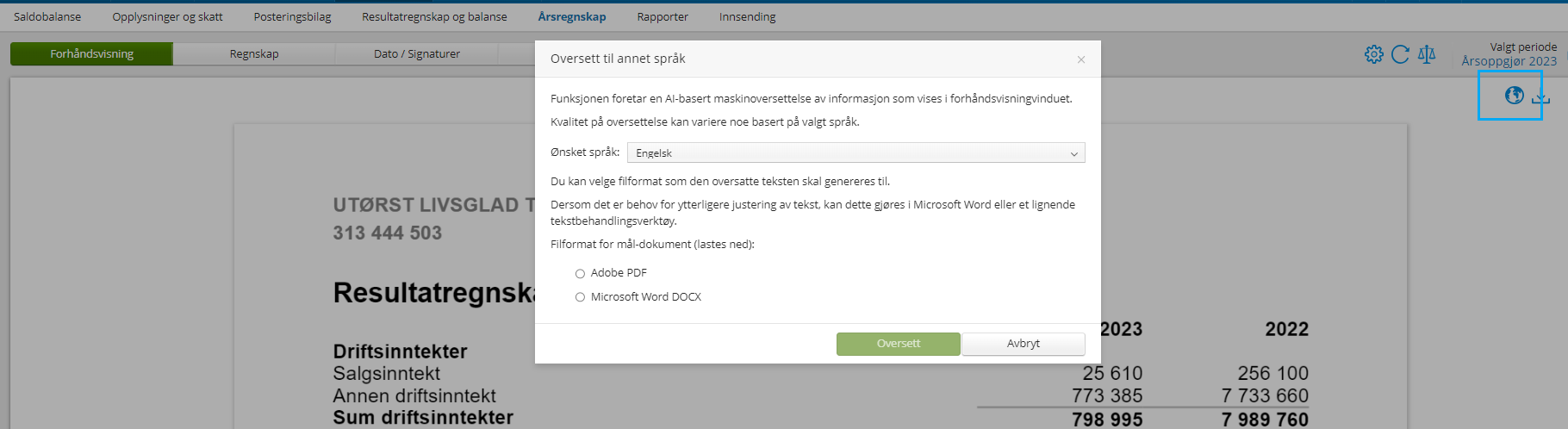

Annual report - support for English translation

It is now possible to generate an AI-based machine translation of the annual report to English. You can choose between the file format Adobe PDF or Microsoft Word DOCX.

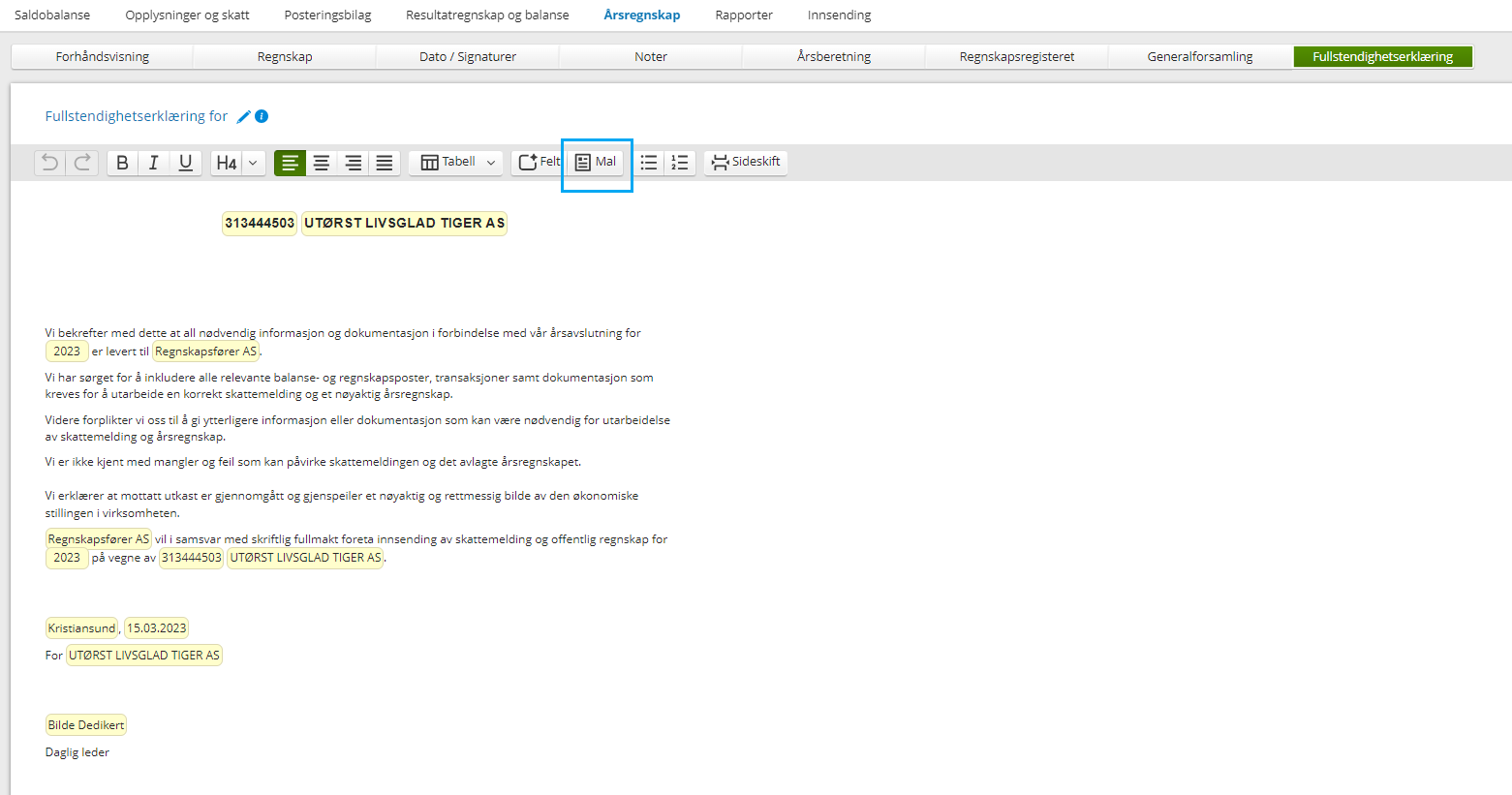

Annual report - standard templates available

Standard templates for the following protocols is now available in Annual report;

- General assembly protocol

- Board report

- Declaration of completeness

Support for deviating accounting year

Tax information based on previously prepared year-end closing can now be imported from Total, Finale and Altinn and it is possible to prepare a new year-end closing with deviating financial year in Period & Year. The supported combinations include regular deviating fiscal years, as well as transitions to and from calendar years/deviating fiscal years. If the accounting periods are defined correctly in the ERP system, the ERP system can be used as the import source; otherwise, Excel must be used.

Read more about Deviating accounting year.

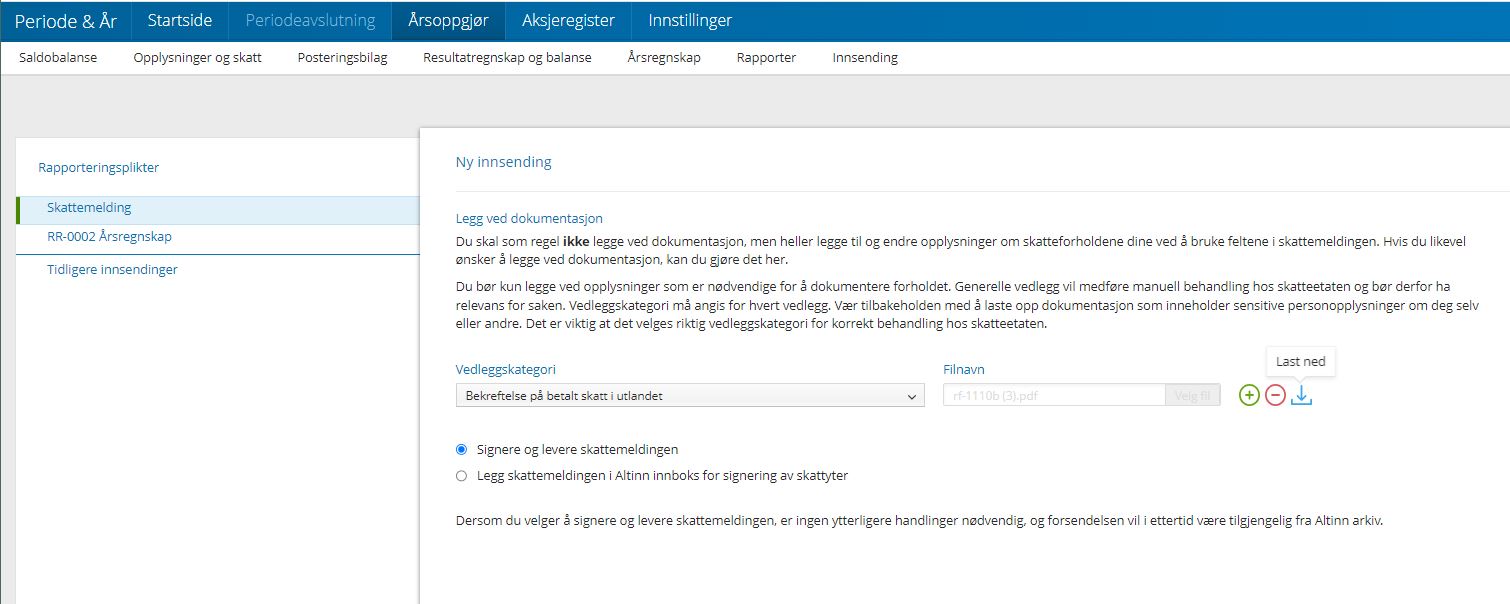

Submission - store uploaded attachments

Attachments submitted with the Tax return or Annual report are now stored on the client in Period & Year. It is also possible to download these attachments later.

Annual report - edit content in field value

By converting the field to regular text it is now possible to edit content in field values in Annual report.

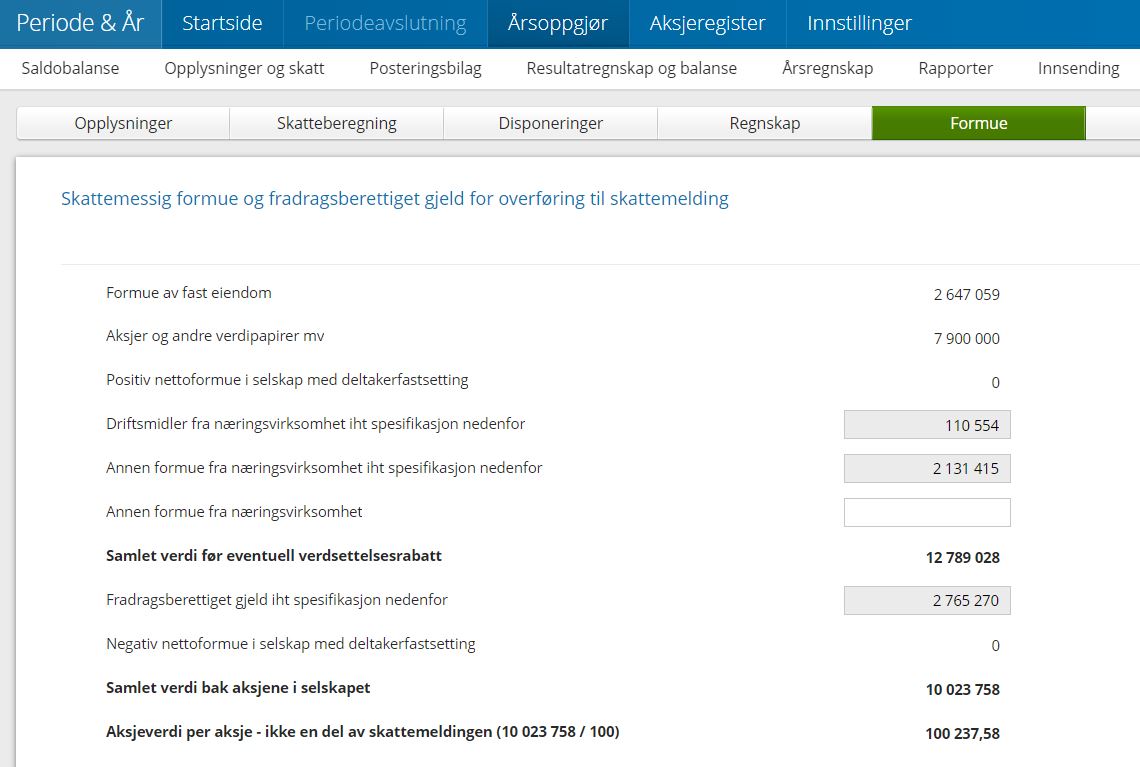

Wealth - display of share value per share

Calculation of Share value per share has been added in the menu and report Wealth.This information is not part of the tax return.

RF-1086 Shareholder register statement opened for submission of 2024

Altinn has opened for submission of the Shareholder register statement for 2024. Go to Share register to register and submit events for 2024. Read more about Share register.

Import from Altinn - historical data from 2022 (new format)

By selecting Altinn as the source for historical data, you will now also be able to download the latest tax return with supporting additional information that was submitted with the tax return in a new format for 2022.

- Tax return (impersonal and personal)

- Business specification (impersonal and personal)

Read more about Import of historical data.