May 2024

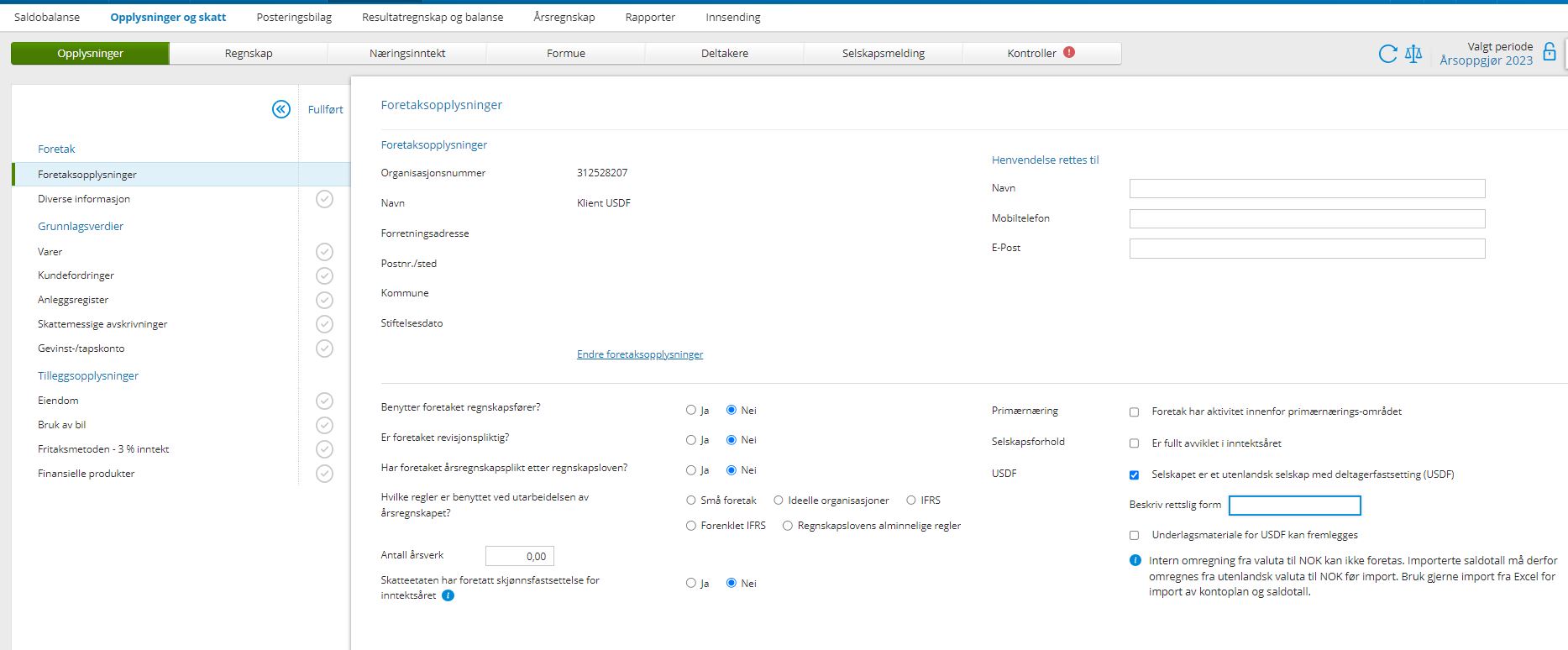

Support for submission of the company tax return for USDF

New functionality to support submission of the company tax return for Norwegian partners in foreign businesses assessed as partnerships (USDF) is now available in Period & Year.

Read more about Foreign businesses assessed as partnerships (USDF).

Closing entries - create a new account when registering closing entry

When searching for an unknown account number while creating a manual closing entry it is now possible to create a new account.

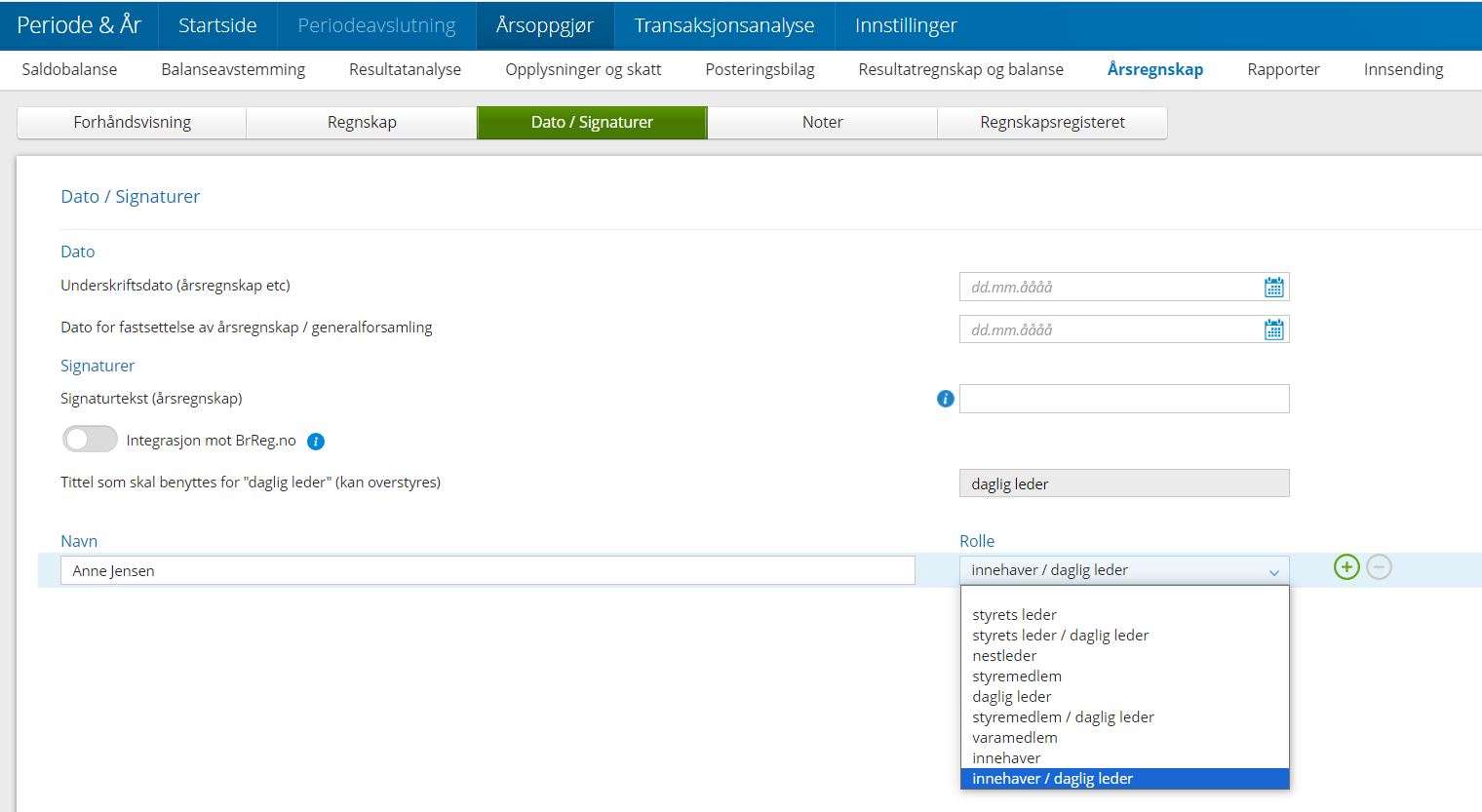

Annual report - ‘owner’ as new signature role

Two new roles has been added for ‘Personal (sole proprietorship)’ in Annual report - Date/Signatures.

- Owner

- Owner / general manager

ERP integration - agricultural clients from PowerOffice GO

It is now possible to import accounting data from agricultural clients from PowerOffice GO.

Read more about the integration in Import of accounting data.

Power company - support for hydroelectric plant

New functionality to support companies with production of hydroelectric plant is now available in Period & Year. The area in Year-end closing consists of the following new registration pages that have conditions that specially apply to hydroelectric plants:

- Hydroelectric plant

- Separate fixed assets in power plants

- Acquisitions of separate fixed assets

- Separate fixed assets under construction

- Taxable depreciations in power plants

Read more about Hydroelectric plants.

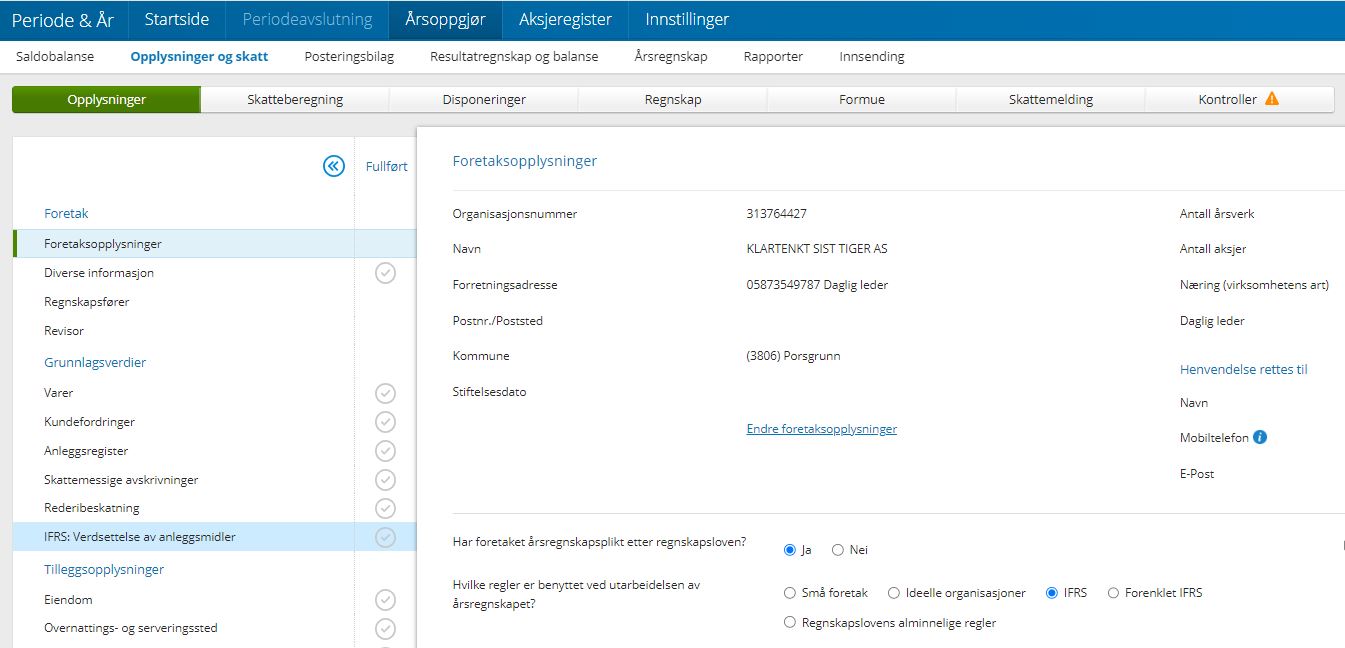

Support for IFRS and simplified IFRS

New functionality to support accounting principle IFRS and simplified IFRS is now available in Period & Year for company category impersonal.

Read more about IFRS.

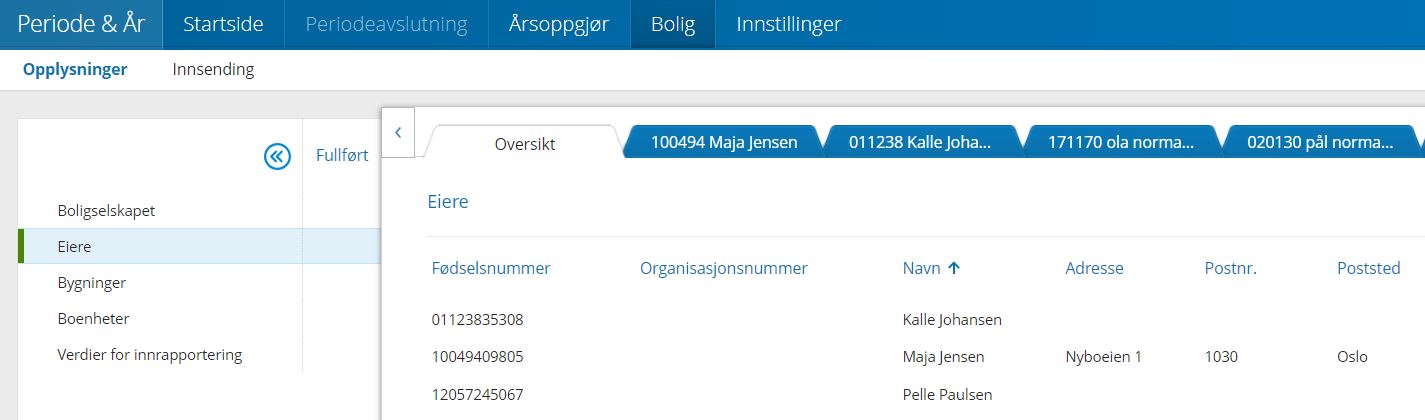

Housing - sort in view for owners and housing units

In Housing it is now possible to sort information in the overview for Owners and Housing units. Click on the column header to change the default sorting order.

Read more about Housing.

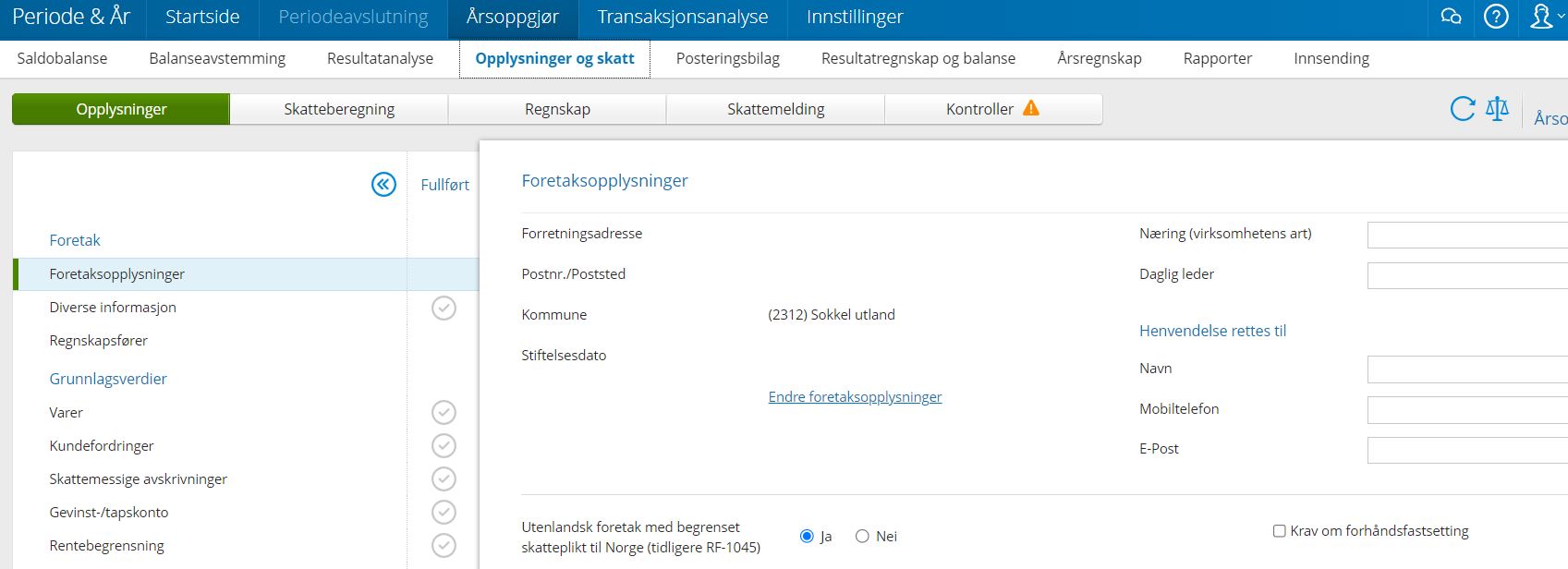

Support for foreign companies with limited tax liability to Norway

New functionality that replaces previous tax form RF-1045 is now available in Period & Year for company type NUF (Norwegian-registered foreign enterprise).

Read more about Foreign companies with limited tax liability to Norway.

Spouse allocation - share data across clients

For sole proprietorship and private person it is now possible to share business income, personal income and wealth/debt across clients within the same accounting office in Period & Year. Exported values from the main practitioner will be available from Tax return - Values from spouse on the other spouse.

Read more about Business income and spouse distribution.

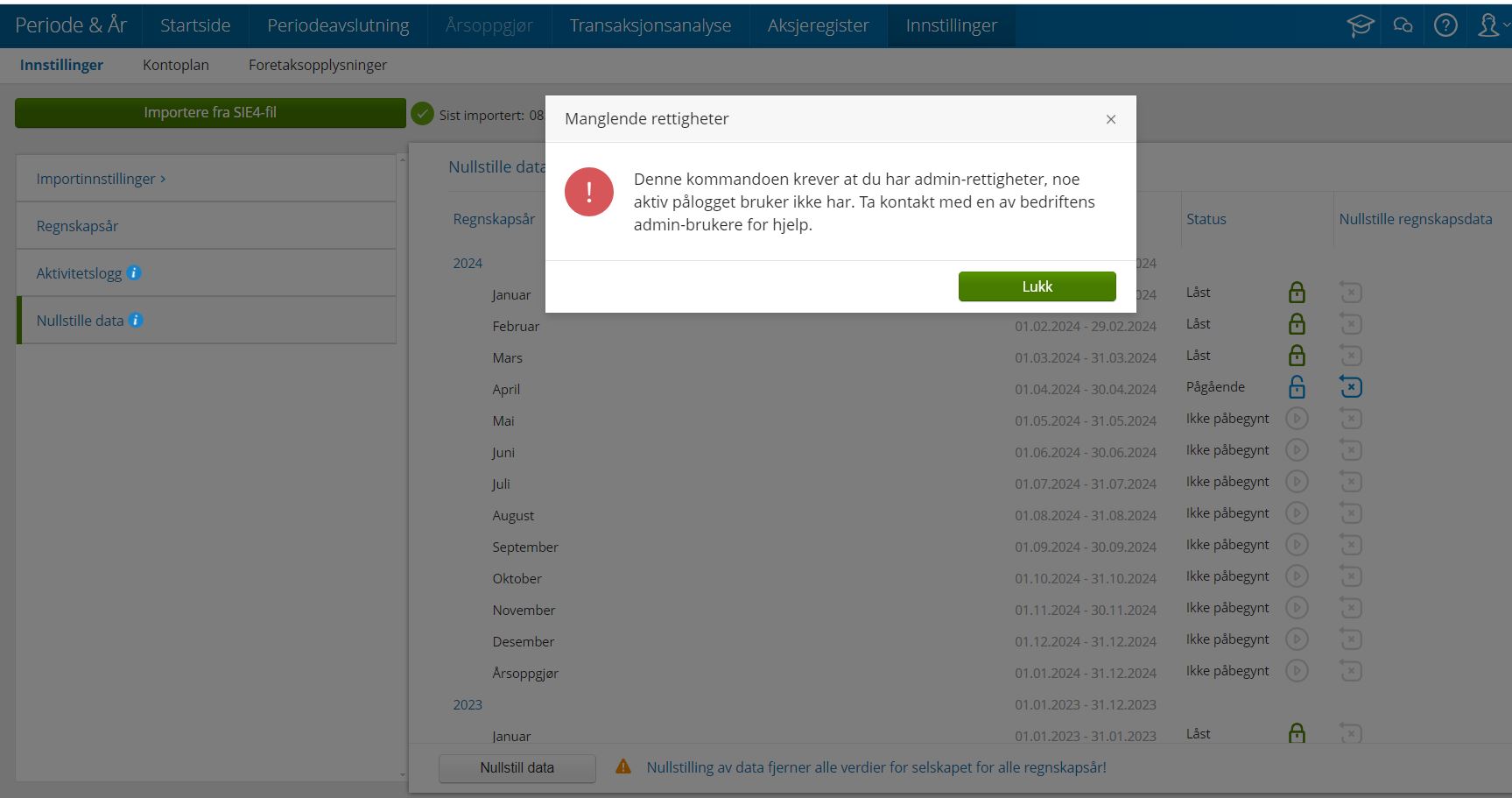

Settings - reset client requires admin user privileges

From now on only users with admin privileges can reset client data in Period & Year . A user without admin users privileges will get the following message if the try to reset client data.